You are here:Bean Cup Coffee > block

Can You Buy Bitcoin on Credit Card?

Bean Cup Coffee2024-09-21 00:14:02【block】4people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has emerged as a popular digital currency that has gained significant atten airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has emerged as a popular digital currency that has gained significant atten

In recent years, Bitcoin has emerged as a popular digital currency that has gained significant attention from investors and consumers alike. With its decentralized nature and potential for high returns, many people are interested in purchasing Bitcoin. However, one common question that arises is whether it is possible to buy Bitcoin using a credit card. In this article, we will explore the possibility of buying Bitcoin on credit card and discuss the pros and cons associated with this method.

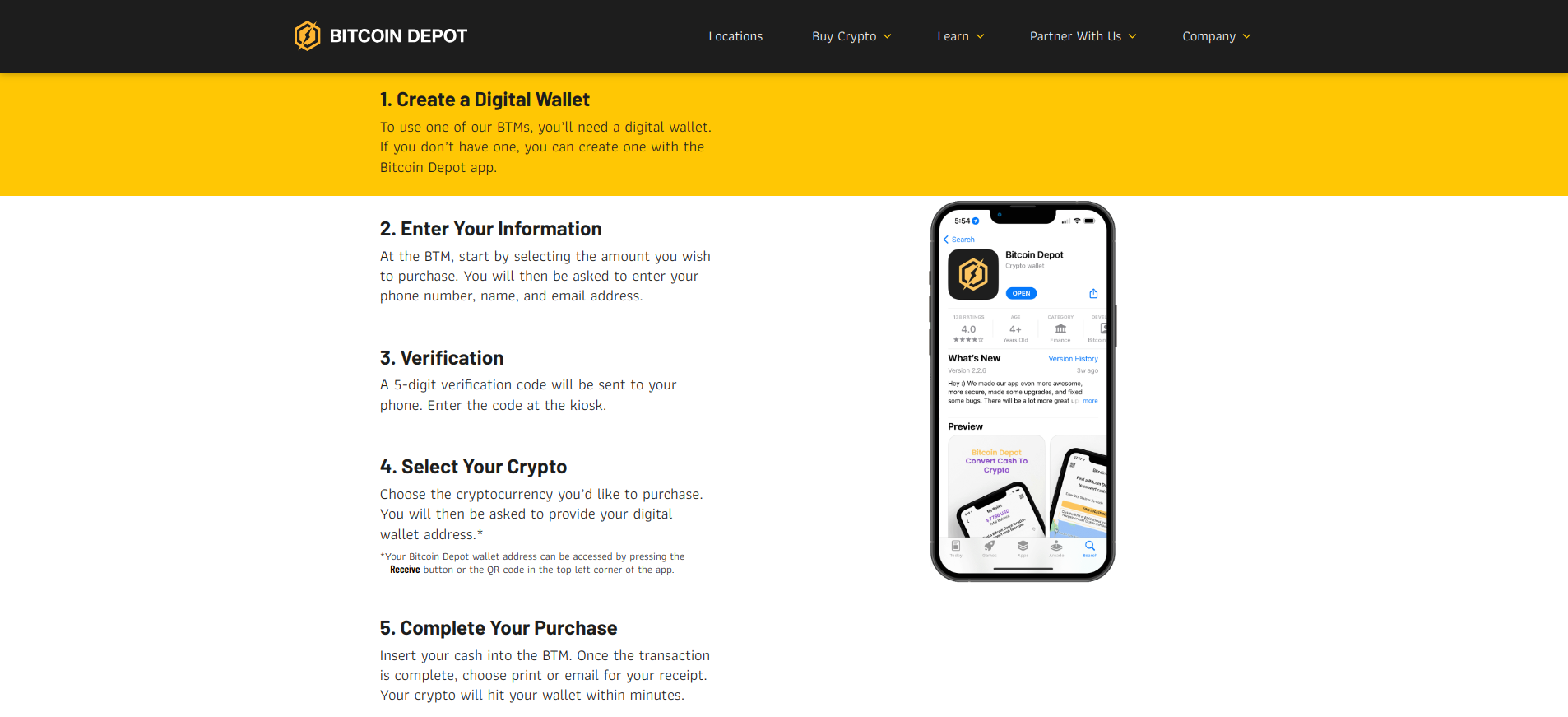

Can you buy Bitcoin on credit card? The answer is yes, you can. There are several platforms and exchanges that allow users to purchase Bitcoin using their credit cards. These platforms often provide a seamless and convenient way to invest in Bitcoin, as they eliminate the need for bank transfers or other payment methods.

One of the most popular platforms for buying Bitcoin on credit card is Coinbase. Coinbase is a well-known cryptocurrency exchange that offers a user-friendly interface and a wide range of supported cryptocurrencies, including Bitcoin. To purchase Bitcoin on Coinbase using a credit card, you need to create an account, verify your identity, and link your credit card to your Coinbase account. Once your credit card is linked, you can easily buy Bitcoin by specifying the amount you want to purchase.

Another platform that allows you to buy Bitcoin on credit card is Kraken. Kraken is a popular cryptocurrency exchange that offers a variety of trading options, including margin trading and futures trading. To buy Bitcoin on Kraken using a credit card, you need to create an account, verify your identity, and link your credit card to your Kraken account. Once your credit card is linked, you can purchase Bitcoin by specifying the amount you want to buy.

While it is possible to buy Bitcoin on credit card, there are some important considerations to keep in mind. One of the main drawbacks of using a credit card to purchase Bitcoin is the high transaction fees. Many exchanges charge a premium for credit card transactions, which can significantly increase the cost of purchasing Bitcoin. Additionally, using a credit card to buy Bitcoin can lead to high interest charges if you are unable to pay off the balance in full by the due date.

Another important consideration is the risk of credit card fraud. When you use your credit card to purchase Bitcoin, you are exposing yourself to the risk of credit card fraud. If your credit card information is stolen, the hacker may use it to make unauthorized purchases, including Bitcoin purchases. It is crucial to keep your credit card information secure and monitor your credit card statements regularly for any suspicious activity.

Despite the drawbacks, there are still reasons why you might choose to buy Bitcoin on credit card. One of the main advantages is the convenience and speed of the transaction. Purchasing Bitcoin using a credit card allows you to quickly and easily invest in Bitcoin without the need to wait for bank transfers or other payment methods. Additionally, some investors may prefer to use their credit card to take advantage of rewards or cashback offers that are available on certain credit cards.

In conclusion, the answer to the question "Can you buy Bitcoin on credit card?" is yes. While there are drawbacks to consider, such as high transaction fees and the risk of credit card fraud, the convenience and speed of purchasing Bitcoin using a credit card make it an attractive option for many investors. If you decide to use your credit card to buy Bitcoin, it is important to carefully consider the potential risks and benefits and to take steps to protect your credit card information.

This article address:https://www.nutcupcoffee.com/blog/02b54999448.html

Like!(35)

Related Posts

- Understanding Bitcoin Wallets: The Ultimate Guide to Securely Managing Your Cryptocurrency

- Which Bitcoin Wallet to Use in the UK: A Comprehensive Guide

- Who Invented Bitcoin Mining: The Pioneers of Cryptocurrency Mining

- Title: Enhancing Cryptocurrency Security with the Jordan Bitcoin Wallet

- **Stack Overflow Bitcoin Mining Algorithm: A Comprehensive Guide

- Lowest Price Bitcoin Exchange: Your Ultimate Guide to Finding the Best Deals

- **How to Move Bitcoin from Coinbase to a Hardware Wallet

- Luna Binance Listing Time: A New Era for Crypto Investors

- Bitcoin Final Price: A Comprehensive Analysis

- The PC Bitcoin Mining Rig: A Comprehensive Guide to Building and Maintaining Your Own Cryptocurrency Mining Setup

Popular

- **How to Buy Floki In Binance: A Comprehensive Guide

- Binance Withdrawal Wrong Network: A Comprehensive Guide to Troubleshooting and Preventing Future Issues

- Bitcoin Price India 2017: A Look Back at the Cryptocurrency's Journey

- Buy Walls Binance: A Comprehensive Guide to Understanding and Utilizing Buy Walls in the Cryptocurrency Market

Recent

How to Withdraw USDT from Binance: A Step-by-Step Guide

What Does Deposit Bitcoin on Cash App Mean?

Current Bitcoin Mining Difficulty: A Comprehensive Analysis

MPI Bitcoin Mining: A Glimpse into the Future of Cryptocurrency Extraction

How to Send Bitcoin on Cash App in 2024

Tesla Bitcoin Mining Free: The Ultimate Guide to Harnessing Your Car's Power

Title: Exploring the World of Fee Trading on Binance

**Day Trading Crypto on Binance: A Comprehensive Guide to Navigating the Volatile Markets

links

- Best Bitcoin Price UK: A Comprehensive Guide to Finding the Best Deals

- Mining Bitcoin with 4 GPUs: A Comprehensive Guide

- The Current XMR Bitcoin Price: A Comprehensive Analysis

- Mining Bitcoin with 4 GPUs: A Comprehensive Guide

- What Can I Use Bitcoins For?

- How Can I Find Lost Bitcoins: A Comprehensive Guide

- How to Sell Crypto for USD on Binance: A Step-by-Step Guide

- Buy Floki on Binance: A Comprehensive Guide to Investing in the Future of Cryptocurrency

- How to Withdraw Bitcoin to Cash on Binance: A Step-by-Step Guide

- Bitcoin Mining Companies Hashrate Comparison: A Comprehensive Analysis