You are here:Bean Cup Coffee > chart

Bitcoin Price Adjustment: Understanding the Volatility and Factors Influencing the Cryptocurrency's Value

Bean Cup Coffee2024-09-21 01:51:18【chart】0people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the first and most well-known cryptocurrency, has been experiencing significant price adjus airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the first and most well-known cryptocurrency, has been experiencing significant price adjus

Bitcoin, the first and most well-known cryptocurrency, has been experiencing significant price adjustments since its inception in 2009. The cryptocurrency market is known for its volatility, and Bitcoin's price adjustment is no exception. This article aims to delve into the factors influencing Bitcoin's value and how it adjusts over time.

Firstly, it is essential to understand that Bitcoin price adjustment is a result of various factors, both internal and external to the cryptocurrency market. One of the primary factors is the supply and demand dynamics. As the supply of Bitcoin is capped at 21 million coins, the scarcity of the cryptocurrency can lead to price adjustments. When demand for Bitcoin increases, its price tends to rise, and vice versa.

Another crucial factor contributing to Bitcoin price adjustment is the regulatory environment. Governments and financial institutions around the world have varying stances on cryptocurrencies, which can significantly impact Bitcoin's value. For instance, countries like China and India have imposed restrictions on Bitcoin trading, leading to a decrease in demand and subsequent price adjustments.

Market sentiment also plays a vital role in Bitcoin price adjustment. News, rumors, and speculation can cause rapid price fluctuations. For example, in 2017, Bitcoin experienced a massive bull run, reaching an all-time high of nearly $20,000. This surge was driven by positive news, such as the acceptance of Bitcoin by major companies and increased institutional investment. Conversely, negative news, such as regulatory crackdowns or security breaches, can lead to a drop in Bitcoin's price.

Moreover, technological advancements and innovations in the cryptocurrency space can influence Bitcoin price adjustment. The development of new blockchain technologies, such as the Ethereum network, has sparked debates on whether Bitcoin can maintain its dominance in the market. These discussions can cause investors to reassess their positions, leading to price adjustments.

The correlation between Bitcoin and other financial markets is another factor that contributes to its price adjustment. Many investors view Bitcoin as a digital gold, and its price often correlates with traditional assets like stocks and commodities. For instance, during times of economic uncertainty, Bitcoin has been seen as a safe haven investment, leading to an increase in its value.

Furthermore, the role of whales and institutional investors cannot be overlooked in Bitcoin price adjustment. Whales are individuals or entities holding a substantial amount of Bitcoin, and their actions can significantly impact the market. For instance, if a whale decides to sell a large portion of their Bitcoin holdings, it can lead to a sudden drop in the cryptocurrency's price.

In conclusion, Bitcoin price adjustment is influenced by a multitude of factors, including supply and demand dynamics, regulatory environment, market sentiment, technological advancements, correlation with other financial markets, and the actions of whales and institutional investors. Understanding these factors is crucial for investors looking to navigate the volatile cryptocurrency market. As Bitcoin continues to evolve, its price adjustment will likely remain a topic of interest for both retail and institutional investors.

This article address:https://www.nutcupcoffee.com/blog/05e61799377.html

Like!(12771)

Related Posts

- Binance New Wallet Address: A Comprehensive Guide to Managing Your Cryptocurrency Assets

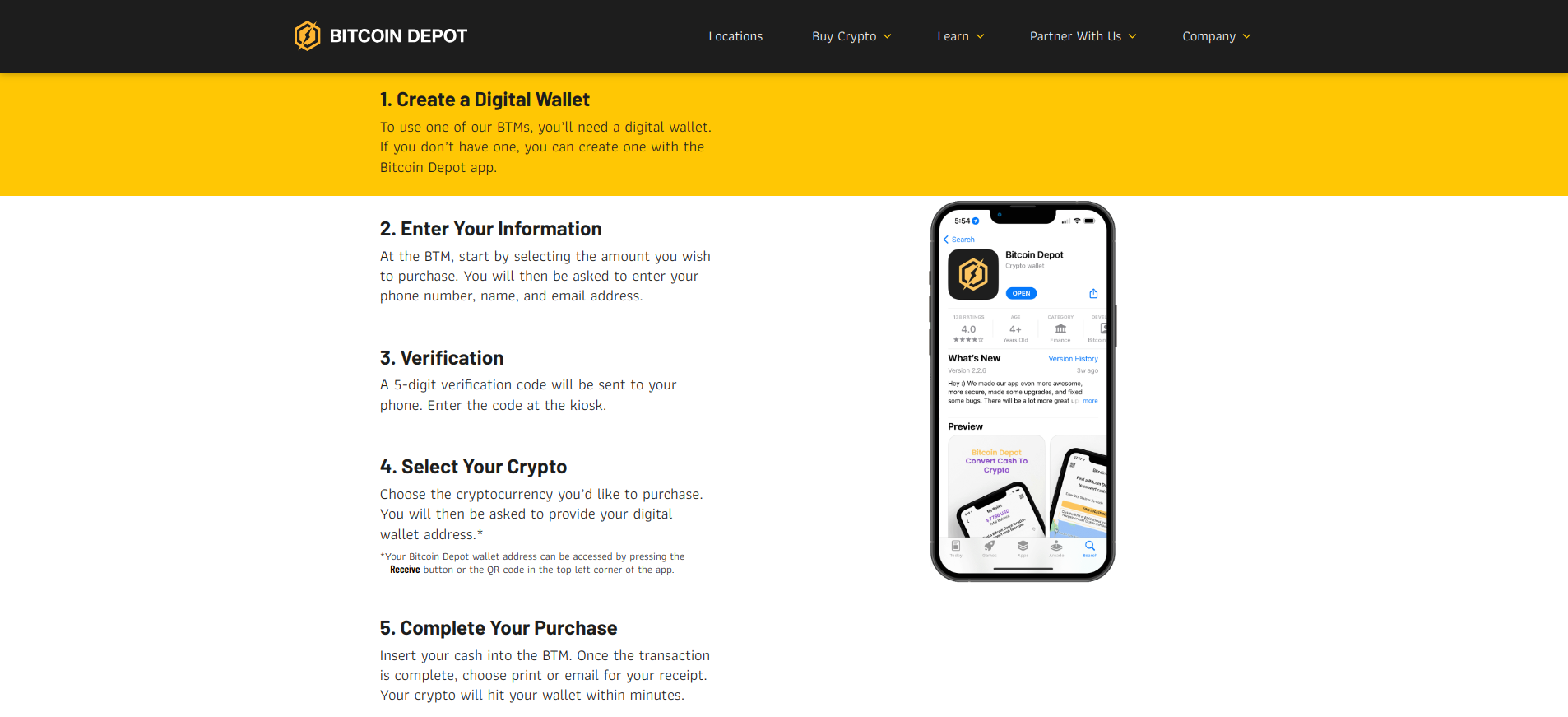

- Cash Out at Bitcoin ATM: A New Era in Cryptocurrency Transactions

- Where Is My Wallet on Binance: A Comprehensive Guide to Finding and Managing Your Cryptocurrency Assets

- Binance Crypto Calculator: A Comprehensive Tool for Cryptocurrency Investors

- WTF Coin Binance: The Rise of a Controversial Cryptocurrency

- Title: How to Withdraw TWT from Binance: A Step-by-Step Guide

- The Importance of Cash App Verification Time for Bitcoin Transactions

- Mining Bitcoin di Laptop: A Practical Guide for Aspiring Cryptocurrency Miners

- How Much is a Bitcoin Mining Machine: A Comprehensive Guide

- Spot Trading Binance Fee: Understanding the Costs and Strategies for Minimizing Them

Popular

Recent

Mining Bitcoin with Excel: A Surprising Approach to Cryptocurrency Extraction

Title: How to Turn Bitcoin into Cash in Canada

Buy BTC on Binance US: A Comprehensive Guide to Secure and Convenient Cryptocurrency Trading

How Do I Get My Money from Binance to Coinbase?

Binance Bake Coin: A New Era of Crypto Innovation

Cash Out at Bitcoin ATM: A New Era in Cryptocurrency Transactions

Why Is Binance Coin Surging?

Can I But Chips with Bitcoin?

links

- How to Buy Bitcoin Using USD Wallet on Coinbase

- Who Can Use Bitcoin Mining?

- Graphics Card Prices Skyrocketing Due to Bitcoin Mining Demand

- How to Trade Bitcoin to Dogecoin on Binance: A Step-by-Step Guide

- Bitcoin Coins Price: The Ever-Changing Landscape of Cryptocurrency

- Bitcoin Coins Price: The Ever-Changing Landscape of Cryptocurrency

- **Bitcoin Cash Dashboard: A Comprehensive Tool for Monitoring the World's Fourth Largest Cryptocurrency

- Is Bitcoin Core Wallet Safe: A Comprehensive Analysis

- Bitcoin Ledger Wallet Download: A Secure Solution for Cryptocurrency Management

- How to Create Your Own Token on Binance Smart Chain