You are here:Bean Cup Coffee > block

Bitcoin Mining Shutdown Price: The Crucial Threshold for Profitability

Bean Cup Coffee2024-09-21 01:34:12【block】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the world of cryptocurrency, the concept of "bitcoin mining shutdown price" has become a crucial airdrop,dex,cex,markets,trade value chart,buy,In the world of cryptocurrency, the concept of "bitcoin mining shutdown price" has become a crucial

In the world of cryptocurrency, the concept of "bitcoin mining shutdown price" has become a crucial factor for miners to determine whether they should continue their operations or shut them down. The shutdown price refers to the price at which the cost of mining a single bitcoin exceeds the revenue generated from selling that bitcoin. This threshold is vital for miners to assess the profitability of their investments and make informed decisions about their mining activities.

The shutdown price is influenced by several factors, including electricity costs, hardware efficiency, and the current market price of bitcoin. As the price of electricity varies significantly across different regions, the shutdown price also varies accordingly. In areas with high electricity costs, the shutdown price is generally higher, making it more challenging for miners to remain profitable.

One of the primary reasons for the fluctuation in the shutdown price is the increasing complexity of mining algorithms. As the difficulty of mining increases, more computational power is required to solve the cryptographic puzzles, which in turn raises the cost of electricity and hardware. Consequently, the shutdown price also rises, posing a significant challenge for miners with outdated or less efficient equipment.

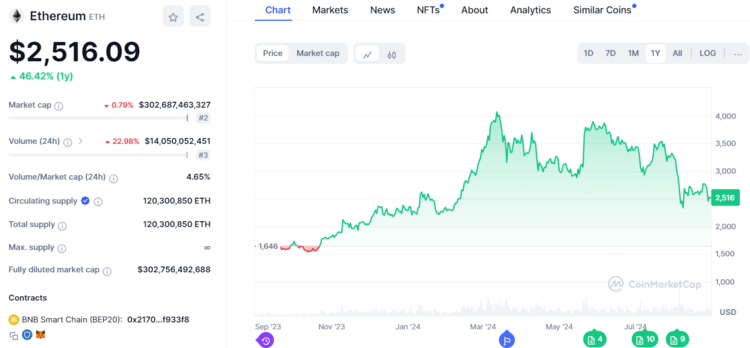

The current shutdown price for bitcoin mining is approximately $9,000. This means that if the price of bitcoin falls below this threshold, miners would start incurring losses, prompting them to shut down their operations. However, it is essential to note that this figure is subject to change based on the aforementioned factors.

Electricity costs play a significant role in determining the shutdown price. In regions with abundant renewable energy sources, such as hydroelectric power, the shutdown price is relatively lower compared to areas with high electricity costs. For instance, miners in China, which has abundant hydropower resources, can operate at a lower shutdown price than their counterparts in the United States or Europe.

Hardware efficiency is another critical factor that affects the shutdown price. Miners with more efficient equipment can mine more bitcoins with the same amount of electricity, reducing their overall costs and increasing their chances of profitability. As a result, the adoption of newer and more efficient mining hardware has become a priority for miners looking to stay competitive in the market.

The current market price of bitcoin also has a direct impact on the shutdown price. When the price of bitcoin is high, the revenue generated from mining increases, allowing miners to operate at a higher shutdown price. Conversely, when the price of bitcoin falls, the shutdown price decreases, making it more challenging for miners to remain profitable.

In conclusion, the bitcoin mining shutdown price is a crucial threshold that miners must consider to determine the profitability of their operations. As the price of electricity, hardware efficiency, and the market price of bitcoin fluctuate, so does the shutdown price. Miners must stay informed about these factors and adapt their strategies accordingly to ensure long-term profitability. By understanding the shutdown price, miners can make informed decisions about their investments and contribute to the stability and growth of the cryptocurrency market.

This article address:https://www.nutcupcoffee.com/blog/09a09399897.html

Like!(1588)

Related Posts

- Can I Buy Bitcoin with a Cashiers Check?

- How to Cash in Bitcoin on Coinbase: A Step-by-Step Guide

- Mineral Oil Bitcoin Mining: A Sustainable Approach to Cryptocurrency Extraction

- Bitcoin Live Price Chart GBP: A Comprehensive Guide to Tracking Bitcoin's Value in British Pounds

- Bitcoin Price in Future: A Comprehensive Analysis

- What Causes Bitcoin Prices to Fluctuate

- Do You Make Money Mining Bitcoin?

- How to Connect Bitcoin Wallet to Bank Account in Canada with CIBC

- Bitcoin Cash Easy Miner: A Game-Changer for Cryptocurrency Mining

- Zombie Computers Mining Bitcoins: A Growing Threat to Cybersecurity

Popular

Recent

Bitcoin Cash Casino Florida: A New Era of Online Gaming

sites list

Bitcoin and Altcoin Prices: A Comprehensive Analysis

How to Trade Through Binance: A Comprehensive Guide

Bitcoin Mining is Not Profitable: The Reality Behind the Hype

Title: Enhancing Bitcoin Transactions with the Bitcoin Lightning Network Crypto Wallet to

Besty Mining Software Pools for Bitcoin: The Ultimate Guide

The Profitability of Bitcoin Mining: A Comprehensive Analysis

links

- Bitcoin Mining Software for Linux Ubuntu: A Comprehensive Guide

- The Rising Costs of Mining Bitcoin: A Comprehensive Analysis

- When is Bitcoin Cash Halving 2024?

- Title: Understanding the Binance Smart Chain RPC URL: A Comprehensive Guide

- Binance, one of the leading cryptocurrency exchanges in the world, has recently introduced a new feature that has caught the attention of crypto enthusiasts everywhere: the Peipei Coin. This innovative addition to the Binance platform promises to enhance the user experience and offer unique opportunities for traders and investors.

- Nasdaq Live Bitcoin Prices: A Real-Time Window into Cryptocurrency's Volatility

- GTX 1060 3GT for Mining Bitcoin: A Cost-Effective Solution

- Binance Wallet Address Private Key: Understanding Its Importance and Security Measures

- Can My Bitcoin Be Worth Nothing Overnight?

- Atomic Wallet Bitcoin Wallets: The Ultimate Guide to Secure and Convenient Cryptocurrency Management