You are here:Bean Cup Coffee > airdrop

Why Is the Price of Bitcoin Different in Every Broker?

Bean Cup Coffee2024-09-21 01:26:17【airdrop】2people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market has been a hot topic of discussion for quite some time now, with Bitcoin b airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market has been a hot topic of discussion for quite some time now, with Bitcoin b

The cryptocurrency market has been a hot topic of discussion for quite some time now, with Bitcoin being the most popular and widely recognized digital currency. One of the most common questions that arise among investors and enthusiasts is why the price of Bitcoin is different in every broker. This article aims to shed light on the reasons behind this discrepancy.

First and foremost, it is important to understand that Bitcoin is a decentralized digital currency, which means that its price is not controlled by any single entity. Instead, it is determined by the supply and demand dynamics in the market. However, the way these dynamics manifest themselves can vary from one broker to another, leading to differences in Bitcoin prices.

One of the primary reasons why the price of Bitcoin is different in every broker is due to the varying fees and commissions charged by each platform. Brokers often have different pricing structures, which can include flat fees, percentage-based fees, or a combination of both. These fees can significantly impact the final price that an investor pays for Bitcoin, as well as the price they receive when selling their holdings.

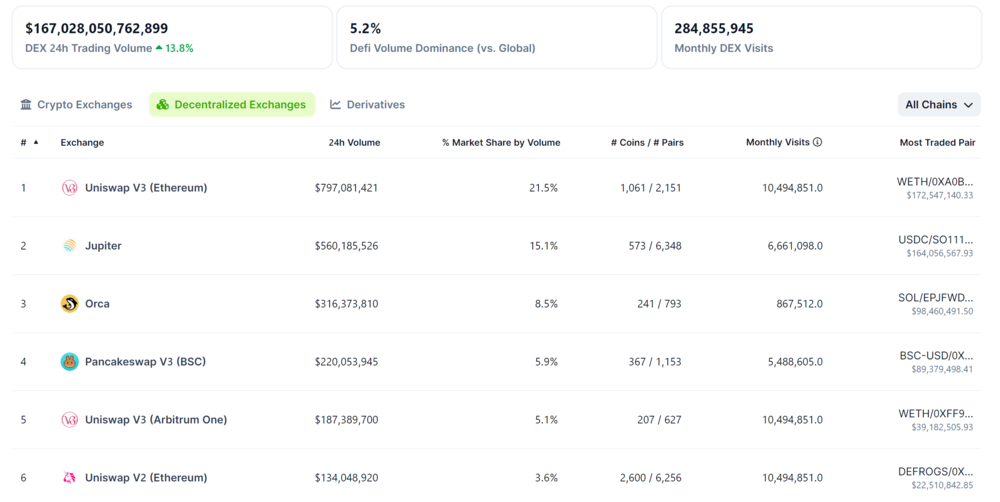

Another factor contributing to the price discrepancy is the liquidity of the market. Liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. In the case of Bitcoin, brokers with higher liquidity tend to offer more competitive prices, as they can execute trades quickly and efficiently. Conversely, brokers with lower liquidity may experience wider spreads, leading to higher prices for buyers and lower prices for sellers.

The geographical location of the broker can also play a role in the price differences. Different regions may have varying regulations and tax policies that can affect the overall supply and demand of Bitcoin. For instance, some countries may have more stringent regulations on cryptocurrency trading, which can limit the number of participants in the market and, in turn, impact prices.

Moreover, the reputation and credibility of the broker can influence the price of Bitcoin. Established brokers with a strong track record of reliability and security tend to attract more traders, which can lead to higher liquidity and more competitive prices. On the other hand, brokers with a less-than-stellar reputation may struggle to attract customers, resulting in lower liquidity and potentially higher prices.

Lastly, the presence of market manipulators and speculative trading can also contribute to the price discrepancies. Some individuals or groups may attempt to manipulate the market by buying or selling large amounts of Bitcoin to drive up or down its price. This behavior can create artificial price movements that are not reflective of the true supply and demand dynamics, leading to inconsistencies across different brokers.

In conclusion, the price of Bitcoin can vary in every broker due to a combination of factors, including fees, liquidity, geographical location, broker reputation, and market manipulation. As an investor, it is crucial to research and compare different brokers to find the one that offers the most competitive prices and aligns with your investment goals. By understanding the reasons behind the price discrepancies, you can make more informed decisions and potentially maximize your returns in the cryptocurrency market.

This article address:https://www.nutcupcoffee.com/blog/0a69899301.html

Like!(6)

Related Posts

- Binance Send Bitcoin: A Comprehensive Guide to Sending Bitcoin on Binance

- Which Country Can Use Binance: A Comprehensive Guide

- **The Ultimate Guide to Understanding Bitcoin Cryptocurrency Wallet 1gxazhvqudjetpe62ufozfibpa8todoun3

- Binance Chain Wallet Extension for Microsoft Edge: A Comprehensive Guide

- Can Bitcoin Exist Without Miners?

- Cathy Wood Bitcoin Price: The Future of Cryptocurrency and Investment Opportunities

- Monero vs Bitcoin Price: A Comprehensive Analysis

- How to Find a Bitcoin Wallet: A Comprehensive Guide

- Binance Chain on Ledger: A Secure and User-Friendly Crypto Experience

- ### A Comprehensive Guide to Aplikasi Mining Bitcoin Android 2017

Popular

Recent

But Bitcoin with Google Wallet: A New Era of Digital Transactions

How to Buy Shiba Inu on Binance App: A Step-by-Step Guide

Bitcoin Price End of 2025: Predictions and Speculations

Bitcoin Price Estimate 2017: A Look Back at the Cryptocurrency's Journey

Bitcoin Price Early 2017: A Look Back at the Cryptocurrency's Rapid Rise

Bitcoin Mining Revenue: The Lucrative World of Cryptocurrency Mining

When Can We Register on Binance: A Comprehensive Guide

Bitcoin Cash Investopedia: Understanding the Cryptocurrency and Its Investment Potential

links

- Bitcoin Cash Mining Pool Breakdown: Causes, Implications, and Future Outlook

- Bitcoin Price Live: A Deep Dive into the Real-Time Binance Market

- How Many Coins Does Binance US Have?

- What is the Advantage of Bitcoin over Cash Currency?

- What Was the Price of Bitcoin in 2014?

- What Do I Need for Bitcoin Mining?

- Binance to Hardware Wallet Fees: Understanding the Costs and Benefits

- Bitcoin Highest Price 2011: A Look Back at the Cryptocurrency's Milestone

- Bitcoin Blackrock ETF Price: A Comprehensive Analysis

- Bitcoin Price in 1999: A Glimpse into the Cryptocurrency's Early Days