You are here:Bean Cup Coffee > trade

What Will Bitcoin ETF Do to Price?

Bean Cup Coffee2024-09-20 21:18:49【trade】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The rise of cryptocurrencies has been nothing short of revolutionary, and Bitcoin, as the pioneer of airdrop,dex,cex,markets,trade value chart,buy,The rise of cryptocurrencies has been nothing short of revolutionary, and Bitcoin, as the pioneer of

The rise of cryptocurrencies has been nothing short of revolutionary, and Bitcoin, as the pioneer of this digital gold rush, has captured the imagination of investors worldwide. With the increasing popularity of Bitcoin, many are now looking towards the potential impact of a Bitcoin ETF (Exchange Traded Fund) on its price. So, what will a Bitcoin ETF do to price?

Firstly, it is important to understand that a Bitcoin ETF is a financial instrument designed to track the price of Bitcoin. By providing investors with a regulated and accessible way to invest in Bitcoin, an ETF could potentially attract a broader audience, including institutional investors. This influx of new investors could lead to increased demand for Bitcoin, which, in turn, could drive up its price.

One of the primary effects a Bitcoin ETF could have on price is the removal of the need for intermediaries. Currently, investors looking to purchase Bitcoin must go through various exchanges, which can be cumbersome and risky. A Bitcoin ETF would offer a more straightforward and regulated investment vehicle, making it easier for investors to participate in the Bitcoin market. This could lead to a surge in demand and, subsequently, an increase in price.

Moreover, the introduction of a Bitcoin ETF could also enhance the credibility of the cryptocurrency market. With the backing of a regulated financial institution, a Bitcoin ETF would provide a level of security and trust that many retail and institutional investors may find appealing. This increased confidence in the market could attract more capital, leading to a higher price for Bitcoin.

However, it is not all sunshine and rainbows. There are potential drawbacks to consider as well. One concern is that a Bitcoin ETF could lead to increased volatility in the market. As more investors enter the market, the price of Bitcoin could become more sensitive to news and events, leading to rapid price swings. This volatility could deter some investors and potentially cause the price of Bitcoin to fluctuate widely.

Another concern is the potential for manipulation. With a Bitcoin ETF, a larger pool of capital would be at stake, which could make the market more susceptible to manipulation by large investors or market participants. This could lead to an artificial inflation of the price, which may not reflect the true value of Bitcoin.

In conclusion, the introduction of a Bitcoin ETF could have a significant impact on the price of Bitcoin. While it may lead to increased demand, enhanced credibility, and easier access for investors, it could also result in increased volatility and potential manipulation. The net effect on the price of Bitcoin remains to be seen, but one thing is certain: the crypto market is evolving, and the introduction of a Bitcoin ETF is just one of the many factors that will shape its future.

In the end, what will a Bitcoin ETF do to price? Only time will tell. However, as the crypto market continues to grow and mature, it is essential for investors to stay informed and understand the potential risks and rewards associated with this emerging asset class. Whether a Bitcoin ETF will ultimately drive the price of Bitcoin higher or lower remains to be seen, but one thing is for sure: the crypto market will continue to evolve, and investors should be prepared for the ride.

This article address:https://www.nutcupcoffee.com/blog/12b75599232.html

Like!(4637)

Related Posts

- Can You Cash Out on Binance US?

- Profit Bitcoin Mining Calculator: A Comprehensive Guide to Maximizing Your Returns

- Hong Kong Bitcoin Mining: A Booming Industry in the City of Opportunities

- Shadow Cloud Bitcoin Mining: A Revolutionary Approach to Cryptocurrency Mining

- Energy Wasted Bitcoin Mining: A Growing Concern

- How to Send Tether from Trust Wallet to Binance: A Step-by-Step Guide

- Bitcoin Wallet Restore: A Comprehensive Guide

- Title: Exploring the Integration of UOS Crypto with Binance: A Comprehensive Overview

- Best Bitcoin Mining App 2017: A Comprehensive Review

- The Rise of UST/USDT on Binance: A Game-Changing Crypto Pair

Popular

- Bitcoin Cash BCC Manually Create TX: A Comprehensive Guide

- Title: Streamlining Your Crypto Withdrawals with Binance's Withdraw Wallet Feature

- The Current State of Bitcoin: A Deep Dive into the Cryptocurrency Market at https://www.coinbase.com/price/bitcoin

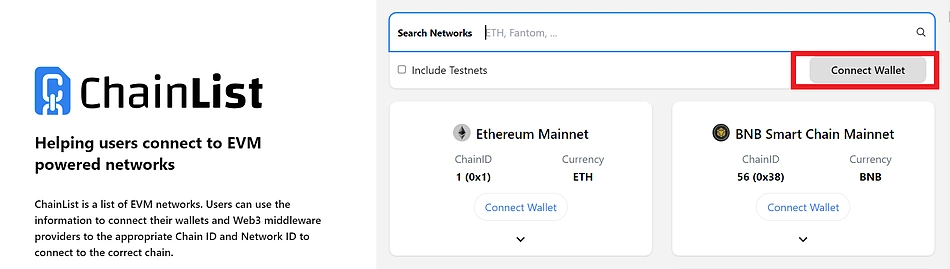

- Adding Binance Smart Chain on Metamask: A Comprehensive Guide

Recent

Bitcoin Price on April 12, 2017: A Look Back at a Historic Day

### USD Wallet to Bitcoin: A Step-by-Step Guide from Coinbase to GDAX

Title: Open a Bitcoin Cash Account: A Step-by-Step Guide to Secure Digital Transactions

How Do I Sell Bitcoin from My Wallet?

### Metamask Binance Chain Network: A Gateway to Decentralized Finance

**Pengalaman Mining Bitcoin: A Journey into the Cryptocurrency World

Bitcoin Price Evolution History: A Journey Through Time

Where Can I Buy Bitcoin with Cash?

links

- No Binance Smart Chain Metamask: A Comprehensive Guide to Understanding the Connection

- Binance vs Mercado Bitcoin: A Comprehensive Comparison

- Binance Minimum Trade Volume: A Comprehensive Guide for Traders

- ### USDT on Binance Chain: The Future of Stablecoin Transactions

- Binance Cardano Wallet: A Comprehensive Guide to Managing Your ADA Assets

- How Do You Receive Bitcoin from Mining?

- Peralatan untuk Mining Bitcoin: The Essential Tools for Success

- Best Bitcoin and Altcoin Hardware Wallets: Secure Your Cryptocurrency Assets

- Amaury Bitcoin Cash: A Visionary Leader in the Cryptocurrency Revolution

- Binance Coin Calculator: A Comprehensive Guide to Understanding Your BNB Holdings