You are here:Bean Cup Coffee > price

How to Spot Trade on Binance: A Comprehensive Guide

Bean Cup Coffee2024-09-21 01:31:25【price】2people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Binance, one of the largest and most popular cryptocurrency exchanges, offers a wide range of tradin airdrop,dex,cex,markets,trade value chart,buy,Binance, one of the largest and most popular cryptocurrency exchanges, offers a wide range of tradin

Binance, one of the largest and most popular cryptocurrency exchanges, offers a wide range of trading options for users. Whether you are a beginner or an experienced trader, it is essential to understand how to spot trade on Binance to maximize your profits and minimize risks. In this article, we will provide you with a comprehensive guide on how to spot trade on Binance, including essential tips and strategies.

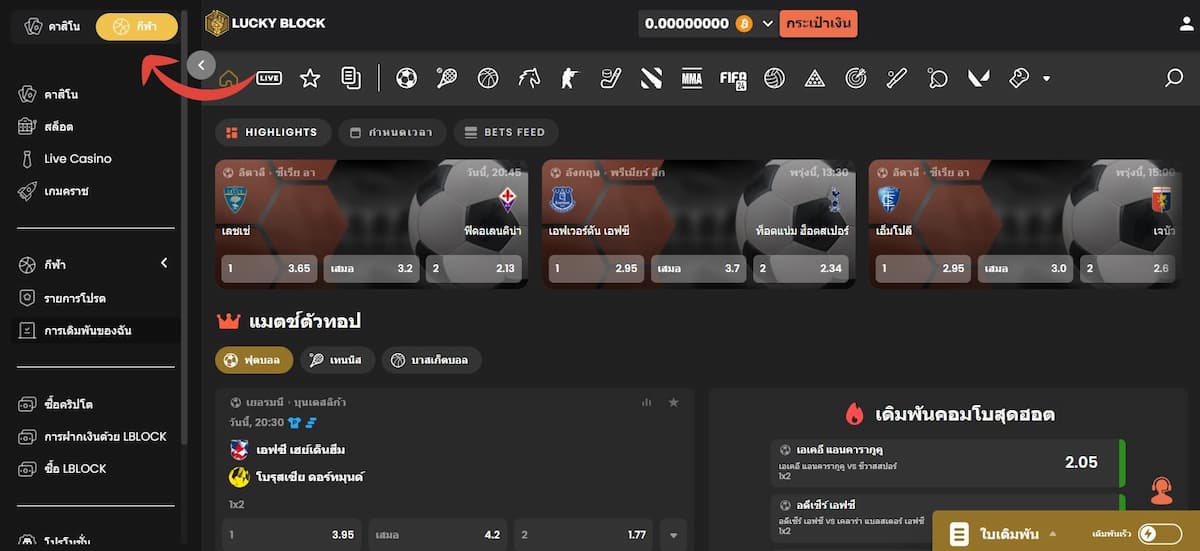

1. Understanding Binance's Trading Interface

Before you start trading on Binance, it is crucial to familiarize yourself with the platform's trading interface. The interface consists of several sections, including the trading pair, order book, chart, and trading panel. Here's a brief overview of each section:

- Trading Pair: This section displays the cryptocurrency pair you are trading, such as BTC/USDT or ETH/BTC.

- Order Book: This section shows the current buy and sell orders for the selected trading pair.

- Chart: The chart provides a visual representation of the trading pair's price movement over time.

- Trading Panel: This section allows you to place buy and sell orders.

2. Analyzing the Order Book

The order book is a crucial tool for spotting trade opportunities on Binance. By analyzing the order book, you can identify potential buy and sell points. Here are some key factors to consider:

- Bid-Ask Spread: The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A narrow spread indicates high liquidity and may provide better trading opportunities.

- Order Depth: Order depth shows the number of buy and sell orders at different price levels. A higher order depth at a particular price level indicates a strong interest in that price.

- Market Sentiment: By observing the order book, you can gauge the market sentiment. If there are more buy orders than sell orders at a particular price level, it may indicate a bullish sentiment, and vice versa.

3. Using the Chart

The chart is another essential tool for spotting trade opportunities on Binance. Here are some tips for using the chart effectively:

- Time Frame: Choose an appropriate time frame based on your trading strategy. For short-term traders, a 1-minute or 5-minute chart may be suitable, while long-term traders may prefer a daily or weekly chart.

- Technical Indicators: Technical indicators, such as moving averages, RSI, and MACD, can help you identify potential trading opportunities. However, it is crucial to use these indicators in conjunction with other analysis tools.

- Price Patterns: Familiarize yourself with common price patterns, such as head and shoulders, triangles, and flags. These patterns can indicate potential reversals or continuation of the current trend.

4. Placing Orders

Once you have identified a potential trading opportunity, it's time to place an order. Here's how to do it:

- Buy Order: To place a buy order, click on the "Buy" button in the trading panel. Enter the desired amount and price, then click "Buy Market" or "Buy Limit" based on your strategy.

- Sell Order: To place a sell order, click on the "Sell" button in the trading panel. Enter the desired amount and price, then click "Sell Market" or "Sell Limit" based on your strategy.

5. Monitoring Your Trades

After placing an order, it is crucial to monitor your trades to ensure they are executed as expected. Here are some tips for monitoring your trades:

- Order Status: Check the order status to ensure it has been executed. If the order is not filled, you may need to adjust your strategy or cancel the order.

- Price Movement: Keep an eye on the price movement to ensure your trade is still valid. If the price moves against your position, consider taking action to minimize your losses.

In conclusion, spotting trade opportunities on Binance requires a combination of technical analysis, market sentiment, and risk management. By understanding the trading interface, analyzing the order book and chart, and placing orders effectively, you can improve your chances of success in the cryptocurrency market. Remember to stay informed, practice patience, and never invest more than you can afford to lose.

This article address:https://www.nutcupcoffee.com/blog/13b09899888.html

Like!(1)

Related Posts

- Bitcoin Mining SMB: A Comprehensive Guide to Setting Up and Optimizing Your Small Business Mining Operation

- Bitcoin Share Price in USD: A Comprehensive Analysis

- Binance Export Complete Trade History Range: A Comprehensive Guide

- How to Buy Pundi X on Binance US: A Step-by-Step Guide

- Can I Buy Bitcoin Cash on Coinbase?

- Title: Convert Bitcoin to Cash in Malaysia: A Comprehensive Guide

- Bitcoin Price Today in USD Dollar: A Comprehensive Analysis

- How Can I Verify My Cash App with Bitcoin?

- Change Bitcoin to Cash in Thailand: A Comprehensive Guide

- How Works Pools Wallets Mining in Bitcoin

Popular

Recent

Title: How to Buy Bitcoin Using the Cash App: A Step-by-Step Guide

How to Transfer USDT from OKEx to Binance

Binance Community Coin Round 5: A New Era of Blockchain Innovation

Title: Unveiling the Power of the Claim Bitcoin Wallet APK: A Comprehensive Guide

Buy with Litecoin on Binance: A Comprehensive Guide

Binance Send Bitcoin: A Comprehensive Guide to Sending Bitcoin on Binance

## Difficulty in Bitcoin Mining: A Comprehensive Analysis

Binance USD Withdrawal: A Comprehensive Guide to Secure and Efficient Transactions

links

- Bitcoin Mining Crisis: A Deep Dive into the Challenges and Solutions

- Can Bitcoin Be Predicted?

- Buy Bitcoin with PayPal on Binance: A Comprehensive Guide

- Binance Wallet Performance: A Comprehensive Analysis

- What Was the Lowest Bitcoin Price?

- How to Buy USDT on Binance: A Step-by-Step Guide

- Bitcoin Mining on Android Phone 2017: A Comprehensive Guide

- The Rise of Headless Bitcoin Wallets: A Game-Changer for Cryptocurrency Users

- Bitcoin Mining Revenue Calculator: A Comprehensive Guide to Maximizing Your Earnings

- How to Send Bitcoin from Cash App to Coinbase