You are here:Bean Cup Coffee > block

Bitcoin Mining Profit 2019: A Comprehensive Analysis

Bean Cup Coffee2024-09-21 01:21:56【block】7people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In 2019, the cryptocurrency market experienced a rollercoaster ride, with Bitcoin mining profit bein airdrop,dex,cex,markets,trade value chart,buy,In 2019, the cryptocurrency market experienced a rollercoaster ride, with Bitcoin mining profit bein

In 2019, the cryptocurrency market experienced a rollercoaster ride, with Bitcoin mining profit being a significant factor in the overall performance of the industry. As one of the most popular cryptocurrencies, Bitcoin has always been a focal point for miners and investors alike. This article aims to provide a comprehensive analysis of Bitcoin mining profit in 2019, exploring the factors that influenced it and the potential implications for the future.

Firstly, it is essential to understand that Bitcoin mining profit is influenced by several factors, including the current price of Bitcoin, the cost of electricity, hardware efficiency, and the difficulty of mining. In 2019, the price of Bitcoin fluctuated significantly, with a notable decline in the first half of the year and a subsequent recovery in the latter half.

The Bitcoin mining profit in 2019 was initially affected by the bearish market conditions in the first half of the year. As the price of Bitcoin dropped, the profit margins for miners narrowed, leading to a decrease in the number of active mining rigs. However, as the year progressed, the price of Bitcoin started to recover, and the mining profit margin improved.

One of the key factors that influenced Bitcoin mining profit in 2019 was the cost of electricity. In regions with low electricity costs, such as China and some parts of the United States, miners were able to maintain profitability even during the bearish market conditions. Conversely, miners in countries with high electricity costs faced significant challenges in maintaining profitability.

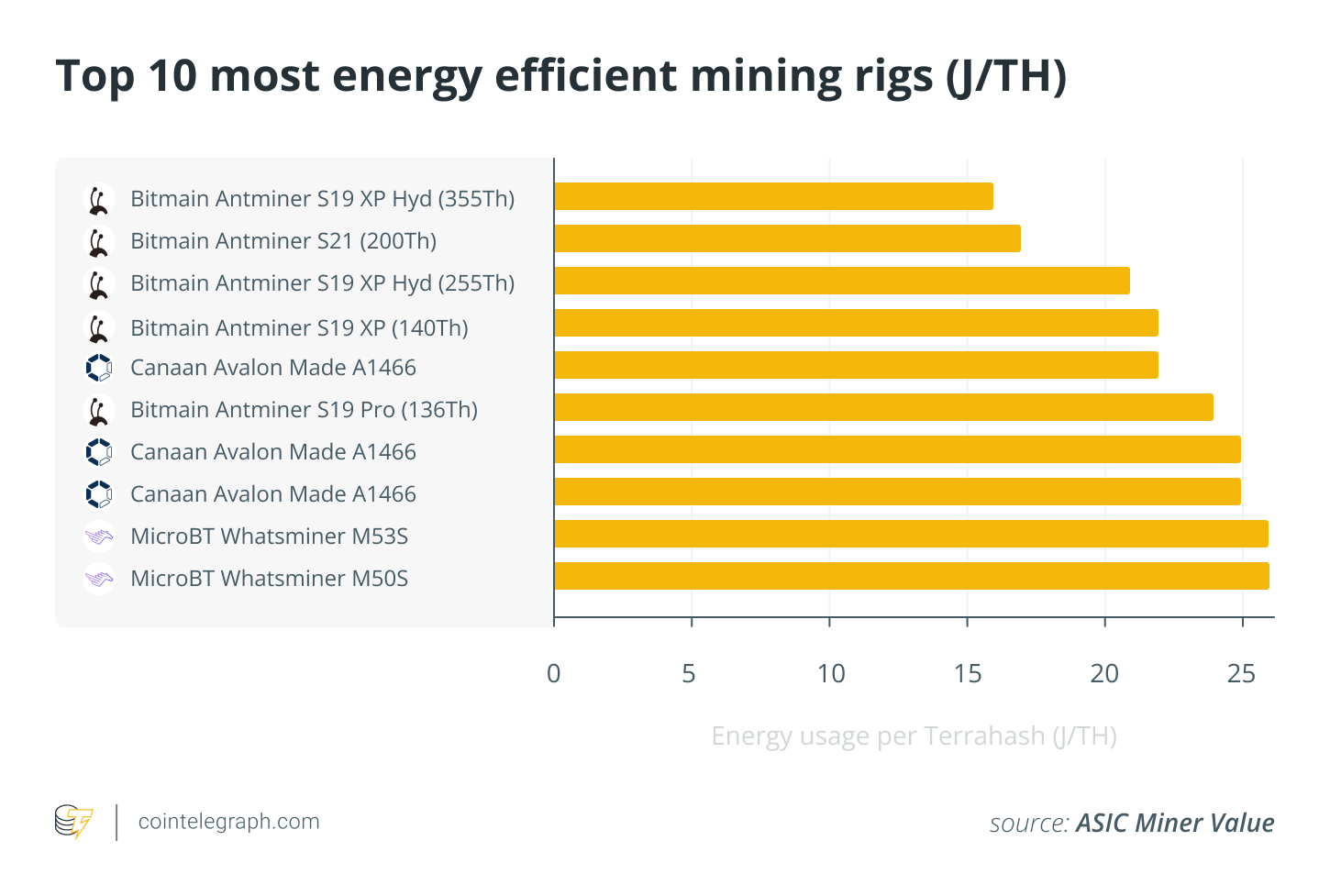

Another crucial factor was the efficiency of mining hardware. In 2019, the introduction of new and more efficient mining rigs helped miners to improve their profit margins. As the technology advanced, the hashrate of mining rigs increased, allowing miners to mine more Bitcoin with the same amount of electricity.

The difficulty of mining also played a significant role in determining Bitcoin mining profit in 2019. The difficulty of mining is a measure of how challenging it is to find a new block in the Bitcoin network. As more miners joined the network, the difficulty increased, leading to a decrease in the number of new blocks found and, consequently, a decrease in the reward for miners.

Despite the challenges faced by Bitcoin miners in 2019, the overall mining profit remained positive. According to various reports, the average mining profit for a Bitcoin miner in 2019 was around $2,000 to $3,000 per month. However, this figure varied significantly depending on the region, hardware efficiency, and electricity costs.

Looking ahead, the potential for Bitcoin mining profit in 2020 and beyond remains uncertain. The market conditions, technological advancements, and regulatory changes will continue to influence the profitability of Bitcoin mining. However, some experts believe that the increasing demand for Bitcoin and the growing adoption of cryptocurrency will lead to a sustained increase in mining profit.

In conclusion, Bitcoin mining profit in 2019 was influenced by a combination of factors, including the price of Bitcoin, the cost of electricity, hardware efficiency, and the difficulty of mining. Despite the challenges faced by miners, the overall mining profit remained positive, with an average profit of $2,000 to $3,000 per month. As the cryptocurrency market continues to evolve, the potential for Bitcoin mining profit in the future remains a topic of interest for both miners and investors.

This article address:https://www.nutcupcoffee.com/blog/13f66499322.html

Like!(562)

Related Posts

- Binance Staking BTC: A Comprehensive Guide to Secure and Rewarding Crypto Investment

- Perfect Bitcoin Mining Rig: The Ultimate Guide to Building Your Own

- The Current State of Price Bitcoin AUD: A Comprehensive Analysis

- Bitcoin Mining in Hotel: A New Trend in the Crypto World

- Bitcoin Price Forecast 2023: What to Expect in the Coming Year

- The Rise of Bitcoin Mining Device: A Game-Changing Technology

- What is Bitcoin Mining Pool?

- Can You Buy Bitcoin with Apple Card?

- **How to Buy Floki In Binance: A Comprehensive Guide

- What Drives Bitcoin Price Fluxuation

Popular

Recent

Bitcoin Cash Hard Fork November 2020: A Comprehensive Analysis

**Understanding Gas Fees on Binance Smart Chain: What You Need to Know

How to Make Quick Cash with Bitcoin

Bitcoin Price on December 31, 2018: A Look Back at a Historic Day

The Importance of Bitcoin Password Wallet: Safeguarding Your Cryptocurrency

Bitcoin Price USD 2005: A Journey Through the Cryptocurrency's Early Days

How to Mine Bitcoin Cash: A Comprehensive Guide

How to Send Bitcoin from Coinbase Wallet to Cash App

links

- Trading Cash for Bitcoin: A Comprehensive Guide to the World of Cryptocurrency

- How Do You Get Cash for Bitcoin?

- Binance Tron Price: A Comprehensive Analysis

- How to Import Bitcoin Paper Wallet: A Comprehensive Guide

- Bitcoin Mining Uses Coal: The Environmental Concerns and Solutions

- Title: Enhancing Cryptocurrency Transactions with Bitcoin Wallet and PayPal Integration

- What is USDT Option on Binance?

- How to Hack a Bitcoin Wallet Private Key: A Comprehensive Guide

- Bitcoin Current Price Today: A Comprehensive Analysis

- Bitcoin Transaction Fee When Price Higher: Understanding the Impact on Network Efficiency