You are here:Bean Cup Coffee > airdrop

Bitcoin Price CAD Prediction: What the Future Holds for the Cryptocurrency Market

Bean Cup Coffee2024-09-20 23:35:44【airdrop】1people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market has been a rollercoaster ride for investors, with Bitcoin leading the pack airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market has been a rollercoaster ride for investors, with Bitcoin leading the pack

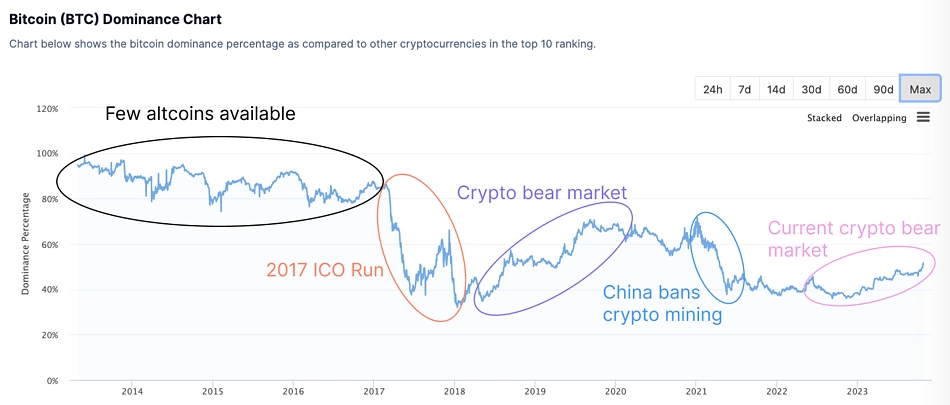

The cryptocurrency market has been a rollercoaster ride for investors, with Bitcoin leading the pack. As the most popular cryptocurrency, Bitcoin has captured the attention of investors worldwide. One of the most frequently asked questions among investors is the Bitcoin price CAD prediction. This article aims to provide insights into the potential future of Bitcoin's price in Canadian dollars.

Bitcoin Price CAD Prediction: Factors Influencing the Market

Several factors influence the Bitcoin price CAD prediction, and understanding these factors is crucial for making informed decisions. Here are some of the key factors:

1. Market Sentiment: The cryptocurrency market is highly speculative, and market sentiment plays a significant role in determining Bitcoin's price. Positive news, such as regulatory support or increased adoption, can lead to a surge in Bitcoin's price, while negative news, such as regulatory crackdowns or security breaches, can cause a drop.

2. Supply and Demand: The supply of Bitcoin is limited, with a maximum supply of 21 million coins. As the demand for Bitcoin increases, its price tends to rise. Conversely, if the demand decreases, the price may fall.

3. Economic Factors: Economic factors, such as inflation rates, currency devaluation, and geopolitical tensions, can also impact the Bitcoin price CAD prediction. Investors often turn to Bitcoin as a hedge against economic uncertainty, which can drive up its price.

4. Technological Advancements: The development of new technologies, such as the implementation of the Lightning Network, can enhance Bitcoin's scalability and efficiency, potentially increasing its adoption and, in turn, its price.

Bitcoin Price CAD Prediction: Short-term vs. Long-term Outlook

The Bitcoin price CAD prediction varies depending on the time frame considered. Here's a brief overview of both short-term and long-term outlooks:

Short-term Outlook:

In the short term, the Bitcoin price CAD prediction is subject to volatility. Factors such as regulatory news, market sentiment, and economic events can cause significant price fluctuations. While some experts predict a potential bull run in the short term, others caution that the market may experience a correction before resuming its upward trend.

Long-term Outlook:

In the long term, the Bitcoin price CAD prediction is more optimistic. Many experts believe that Bitcoin has the potential to become a mainstream asset class, similar to gold. As more investors and institutions adopt Bitcoin, its price may continue to rise. Additionally, the increasing adoption of blockchain technology and the growing demand for digital assets could contribute to Bitcoin's long-term growth.

Bitcoin Price CAD Prediction: Risks and Considerations

While the Bitcoin price CAD prediction appears promising, it's essential to consider the risks involved:

1. Regulatory Risk: Governments worldwide are still figuring out how to regulate cryptocurrencies, which can lead to sudden changes in regulations that may impact Bitcoin's price.

2. Market Volatility: The cryptocurrency market is known for its volatility, which can lead to significant price swings in a short period.

3. Security Concerns: Despite advancements in blockchain technology, security concerns remain, which can pose risks to Bitcoin's price.

Conclusion

The Bitcoin price CAD prediction is a complex topic, with various factors influencing the market. While the long-term outlook appears optimistic, investors should be aware of the risks involved. As the cryptocurrency market continues to evolve, staying informed and making informed decisions is crucial for investors looking to capitalize on the potential growth of Bitcoin.

This article address:https://www.nutcupcoffee.com/blog/20d3099949.html

Like!(568)

Related Posts

- The Odds of Success Mining Bitcoins: A Comprehensive Analysis

- Title: Enhancing Bitcoin Cash Transactions with Wallet Electrum Bitcoin Cash

- Why Can't I Send Bitcoin from My Cash App?

- Coinbase Stole Bitcoin Cash: The Controversy That Divided the Cryptocurrency Community

- **Bitcoin Wallet in Colombia: A Gateway to Financial Freedom

- Title: The Convenience of Mobile Bitcoin Wallets: A Game-Changer for Cryptocurrency Users

- Title: The Convenience of Mobile Bitcoin Wallets: A Game-Changer for Cryptocurrency Users

- What is Bitcoin Mining in Simple Terms

- Bitcoin Exchange Bitcoin Cash: The Future of Cryptocurrency Trading

- Free Bitcoin Generator for Your Wallet: A Game-Changing Tool for Crypto Enthusiasts

Popular

Recent

The Current State of Bitcoin Cash Price: A Comprehensive Analysis

Title: Exploring the World of Epay Bitcoin Mining

**Withdraw Fees on Binance: Understanding the Costs and Strategies to Minimize Them

**Withdraw Fees on Binance: Understanding the Costs and Strategies to Minimize Them

Best Bitcoin Wallet Linux: The Ultimate Guide to Secure Cryptocurrency Storage

Ledger Bitcoin Cash: A Secure and Convenient Solution for Cryptocurrency Storage

Why Can't I Convert Crypto on Binance?

Can Trinidad Buy Bitcoin?

links

- Title: How to Import Bitcoin Wallet DAT: A Comprehensive Guide

- LCC Bitcoin Cash Fork: A New Chapter in the Cryptocurrency World

- How Do I Buy Bitcoin Cash in Canada?

- Title: Enhancing Cryptocurrency Management with the XVG Bitcoin Wallet

- The Current Vaneck Bitcoin ETF Price: A Comprehensive Analysis

- **The Impact of Tether Printing on Bitcoin Price Fluctuations

- The Rise of Bitfinex, BNB, and Binance in the Cryptocurrency Market

- The Rise of Bitcoin Cash and Litecoin: A Tale of Two Cryptocurrencies

- Can I Buy Bitcoin for 1 Dollar?

- Standard Bitcoin Wallet: A Comprehensive Guide to Secure Cryptocurrency Management