You are here:Bean Cup Coffee > airdrop

Bitcoin Price Rises: A Closer Look at the Cryptocurrency's Surge

Bean Cup Coffee2024-09-20 22:25:46【airdrop】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has emerged as one of the most talked-about assets in the financial world. airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has emerged as one of the most talked-about assets in the financial world.

In recent years, Bitcoin has emerged as one of the most talked-about assets in the financial world. Its price has experienced significant fluctuations, but lately, it has been on an upward trajectory. This article delves into the reasons behind the Bitcoin price rises and explores the factors that have contributed to this surge.

First and foremost, the global economic landscape has played a crucial role in the Bitcoin price rises. In the wake of the COVID-19 pandemic, governments around the world have implemented unprecedented monetary stimulus measures to prop up their economies. This has led to a significant increase in the money supply, causing inflation concerns among investors. As a decentralized digital currency, Bitcoin offers an alternative store of value that is not subject to the same inflationary pressures as fiat currencies. This has attracted a growing number of investors looking to diversify their portfolios and protect their wealth from inflation.

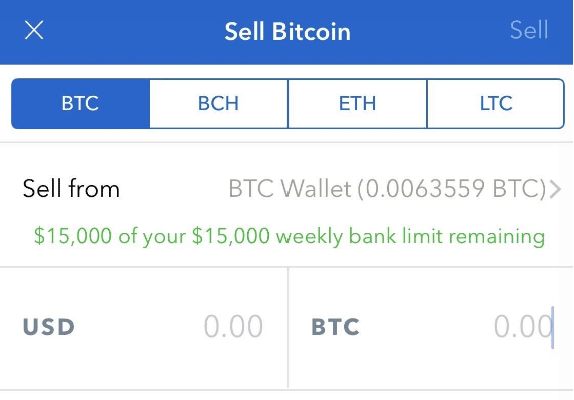

Another factor contributing to the Bitcoin price rises is the increasing institutional interest in the cryptocurrency. Many large financial institutions and corporations have started to recognize the potential of Bitcoin as a digital asset. For instance, PayPal announced in October 2020 that it would allow its users to buy, hold, and sell Bitcoin directly through its platform. This move by PayPal has opened up a new avenue for retail investors to access Bitcoin, thereby increasing its demand and driving up its price.

Furthermore, the ongoing debate about the future of central bank digital currencies (CBDCs) has also contributed to the Bitcoin price rises. As central banks around the world consider issuing their own digital currencies, some investors believe that this could undermine the value of traditional fiat currencies and further boost the demand for Bitcoin. This fear of devaluation has led to a surge in Bitcoin's price, as investors seek to hedge against potential inflation and currency devaluation.

Moreover, the increasing adoption of Bitcoin as a payment method has also played a role in its price rises. A growing number of businesses and online platforms are now accepting Bitcoin as a form of payment, making it more accessible and practical for everyday transactions. This has not only increased the demand for Bitcoin but has also helped to establish its credibility as a legitimate currency.

Lastly, the ongoing debate about the future of Bitcoin has also contributed to its price rises. As Bitcoin's supply is capped at 21 million coins, many investors believe that its scarcity will drive up its value over time. This has led to a speculative frenzy, with investors buying Bitcoin in anticipation of its future price appreciation.

In conclusion, the Bitcoin price rises can be attributed to a combination of factors, including the global economic landscape, institutional interest, the debate about CBDCs, the increasing adoption as a payment method, and the speculative frenzy surrounding its future. As Bitcoin continues to gain traction as a digital asset, its price is likely to remain volatile but could potentially rise further in the coming years. However, it is important for investors to conduct thorough research and exercise caution when investing in Bitcoin, as it remains a highly speculative and risky asset.

This article address:https://www.nutcupcoffee.com/blog/2d00299995.html

Like!(173)

Related Posts

- Why Is the Price of Bitcoin Different Between Exchanges?

- The Rise of Pi Bitcoin Wallet: A Game-Changer in Cryptocurrency Storage

- How Can I Have a Bitcoin Wallet?

- How Much is Bitcoin Mining?

- Bitcoin's Price in 2009: A Journey Through Time

- Bitcoin Next Price: Predictions and Analysis

- How to Set Up Trust Wallet Binance: A Step-by-Step Guide

- Can I Buy Bitcoin at Walgreens Store?

- Bitcoin Mining with Tablet: A New Trend in Cryptocurrency

- May 2017 Bitcoin Price: A Look Back at the Historic Milestone

Popular

Recent

Bitcoin Price Before and After Halving: A Comprehensive Analysis

The Comparison of Transaction Cost Between Bitcoin, Litecoin, and Bitcoin Cash

**The Rise of Trusted Mining Bitcoin: A Secure and Profitable Investment

The Rise of Pi Bitcoin Wallet: A Game-Changer in Cryptocurrency Storage

How to Convert BTC to ETH on Binance: A Step-by-Step Guide

Is There a Bitcoin Wallet App for iPhone?

How to Send Crypto from Binance.US to Trust Wallet

Bitcoin Price Valuation: Understanding the Factors Influencing the Cryptocurrency's Worth

links

- Binance Coin Telegram: A Hub for Crypto Enthusiasts

- **How to Sell Bitcoin Using the BRD Wallet: A Step-by-Step Guide

- Bitcoin Cash Address Converter Legacy: A Nostalgic Journey into the Past

- How to Use Binance Trust Wallet: A Comprehensive Guide

- **New Listing Coin in Binance: A Game-Changing Addition to the Platform

- The Total Sum Earned from Bitcoin Mining: An Overview

- How to Use Bitcoin Mining Monitor Chrome: A Comprehensive Guide

- Can Bitcoin Be Taxed?

- Local Bitcoins Cash in Hand: A Convenient and Secure Way to Buy and Sell Cryptocurrency

- Bitcoin Price if Trump Elected: What to Expect?