You are here:Bean Cup Coffee > crypto

**Short Selling Crypto on Binance: A Comprehensive Guide

Bean Cup Coffee2024-09-20 21:41:28【crypto】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,**In the rapidly evolving world of cryptocurrencies, short selling has emerged as a popular strategy airdrop,dex,cex,markets,trade value chart,buy,**In the rapidly evolving world of cryptocurrencies, short selling has emerged as a popular strategy

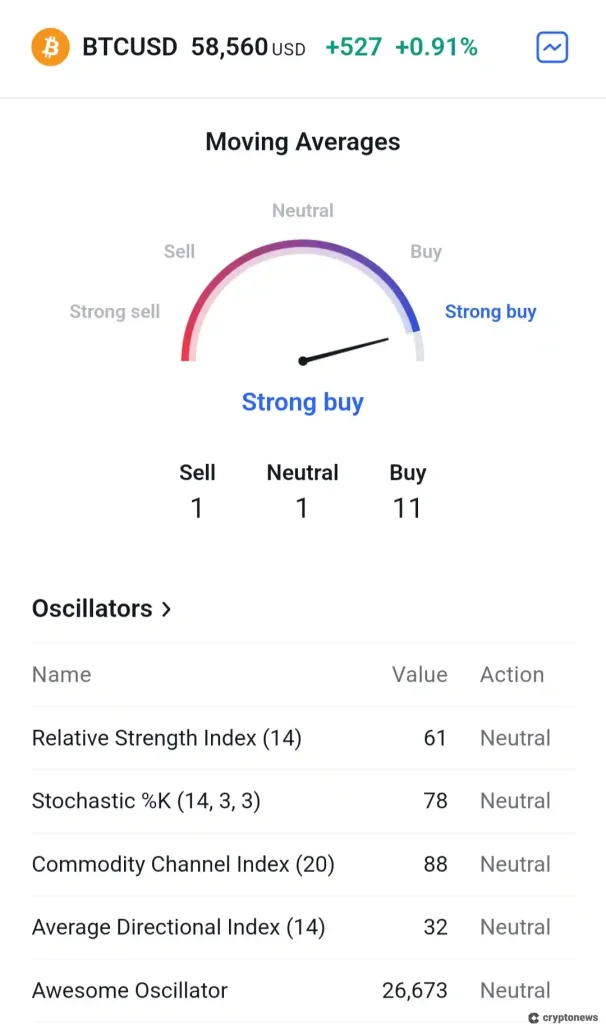

In the rapidly evolving world of cryptocurrencies, short selling has emerged as a popular strategy for investors looking to capitalize on market downturns. Binance, one of the largest cryptocurrency exchanges, offers a platform where traders can engage in short selling crypto. This article delves into what short selling is, how it works on Binance, and the potential risks and rewards involved.

### Understanding Short Selling

Short selling is a trading strategy where an investor borrows a security, typically a stock or cryptocurrency, sells it at the current market price, and then buys it back at a lower price in the future. The difference between the selling and buying price is the profit for the short seller. It's essentially betting on the price of an asset to fall.

### How Short Selling Crypto Works on Binance

Binance, known for its extensive range of trading pairs and advanced features, allows users to short sell cryptocurrencies. Here's a step-by-step guide on how to do it:

1. **Open a Binance Account**: If you haven't already, sign up for a Binance account and complete the verification process.

2. **Deposit Funds**: To engage in short selling, you need to have funds in your Binance account. You can deposit cryptocurrencies or fiat currency, depending on the trading pair you choose.

3. **Choose a Cryptocurrency to Short Sell**: Binance offers a variety of cryptocurrencies that can be shorted. Select the one you want to short sell based on your analysis and market sentiment.

4. **Use Margin Trading**: Binance's margin trading feature allows you to borrow funds to increase your trading leverage. This is essential for short selling as you need to have the cryptocurrency you're shorting.

5. **Place a Short Sell Order**: Once you have the necessary funds and have chosen the cryptocurrency, place a short sell order. This will sell the cryptocurrency at the current market price and borrow it from Binance.

6. **Cover Your Short Position**: As the price of the cryptocurrency falls, you can buy it back at a lower price to cover your short position. The difference between the selling and buying price is your profit.

### Risks and Rewards of Short Selling Crypto on Binance

While short selling crypto on Binance can be lucrative, it also comes with significant risks:

**Risks:

**- **Market Volatility**: Cryptocurrencies are highly volatile, which means prices can skyrocket unexpectedly, leading to substantial losses.

- **Leverage Risks**: Using leverage can amplify gains but also magnify losses.

- **Funding Costs**: When you borrow funds to short sell, you may incur interest costs, which can eat into your profits.

**Rewards:

**- **Profit from Falling Prices**: If you correctly predict that the price of a cryptocurrency will fall, short selling allows you to profit from this decline.

- **Leverage**: Margin trading can increase your potential returns, though it also increases risk.

### Conclusion

Short selling crypto on Binance is a sophisticated trading strategy that can be used to capitalize on market downturns. However, it requires careful analysis, risk management, and a solid understanding of the market. By utilizing Binance's margin trading feature, traders can engage in short selling and potentially profit from falling cryptocurrency prices. As with any investment, it's crucial to do thorough research and consider the risks involved before entering the market.

This article address:https://www.nutcupcoffee.com/blog/42c4499913.html

Like!(729)

Related Posts

- How to Buy Bitcoin Cash with Credit Card: A Step-by-Step Guide

- Which Exchanges Support Bitcoin Cash?

- Bitcoin Price Alerts: The Ultimate Tool for Crypto Investors

- Best Bitcoin Mining App in Nigeria: Your Ultimate Guide to Cryptocurrency Mining

- How to Transfer Money to Bitcoin Wallet in India

- Best Bitcoin Wallet for NiceHash: A Comprehensive Guide

- Cryptocompare Mining Bitcoin: A Comprehensive Guide to Enhancing Your Mining Efficiency

- Title: Enhancing Bitcoin Wallet Security with a Password Manager

- The Price of Bitcoin on Binance: A Comprehensive Analysis

- What Was the Price of Bitcoin at Its Highest?

Popular

Recent

Can I Buy Bitcoin on IG: A Comprehensive Guide

Which Exchanges Support Bitcoin Cash?

Best Bitcoin Prices: How to Find the Best Deals on Cryptocurrency

Binance to Trust Wallet Transfer Fee: Understanding the Costs and Process

Bitcoin Price Early 2017: A Look Back at the Cryptocurrency's Rapid Rise

Title: Harnessing the Power of Bitcoin Price API PHP for Real-Time Cryptocurrency Data

Bitcoin Cold Wallet Test: Ensuring Security and Reliability

Bitcoin Wallet ID and Address: Understanding the Key Components of Cryptocurrency Security

links

- Which Wallet Supports Bitcoin Gold: A Comprehensive Guide

- As Bitcoin prices soar, Genesis Mining Price Pay Out More

- Transaction History on Binance App: A Comprehensive Guide

- Viet Bitcoin Wallet Ledger: A Comprehensive Guide to Managing Your Cryptocurrency Assets

- **The Universal Wallet Bitcoin: A Game-Changing Cryptocurrency Solution

- When Bitcoin Mining: How Many Hashes Are Good?

- Who Invented Bitcoin Price: The Mysterious Creator of the Cryptocurrency

- Why Are Bitcoin Transaction Mining Fees So High?

- How to Mining Bitcoin Free: A Comprehensive Guide

- Bitcoin Wallet vs Bitcoin Core: A Comprehensive Comparison