You are here:Bean Cup Coffee > price

**Flash Loan Binance Smart Chain: Revolutionizing DeFi with Instant Liquidity

Bean Cup Coffee2024-09-20 11:55:44【price】0people have watched

Introductioncrypto,coin,price,block,usd,today trading view,**In the rapidly evolving world of decentralized finance (DeFi), the Binance Smart Chain (BSC) has e airdrop,dex,cex,markets,trade value chart,buy,**In the rapidly evolving world of decentralized finance (DeFi), the Binance Smart Chain (BSC) has e

In the rapidly evolving world of decentralized finance (DeFi), the Binance Smart Chain (BSC) has emerged as a leading platform for innovative financial solutions. One such solution that has gained significant traction is the flash loan, a feature that is reshaping the way users interact with the blockchain. This article delves into the concept of flash loans on the Binance Smart Chain, exploring their benefits, use cases, and the impact they have on the DeFi ecosystem.

### Understanding Flash Loans

A flash loan is a type of loan that allows users to borrow assets from a decentralized lending platform without collateral. The unique aspect of a flash loan is that it must be repaid within the same transaction in which it was borrowed. This means that the loan is essentially a zero-collateral loan, which is a game-changer for the DeFi space.

On the Binance Smart Chain, flash loans are facilitated through smart contracts that enable users to borrow and repay assets in a single transaction. This feature is particularly powerful because it eliminates the need for traditional financial intermediaries, such as banks, and allows for faster and more efficient transactions.

### How Flash Loans Work on Binance Smart Chain

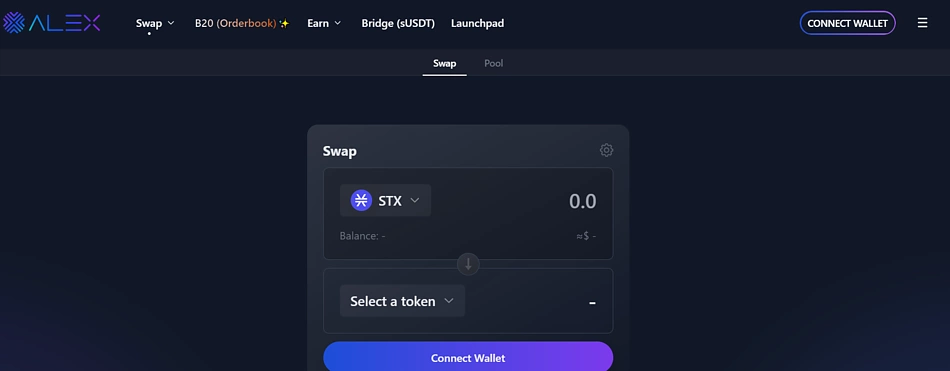

The process of obtaining a flash loan on the Binance Smart Chain is straightforward. Users initiate a transaction that borrows assets from a liquidity pool. These assets can be anything from cryptocurrencies to stablecoins. The borrowed assets are then used to execute a trade or perform a financial operation within the same transaction.

Once the operation is complete, the user must repay the borrowed assets, along with any interest that may have accrued, within the same transaction. If the user fails to repay the loan within the required timeframe, the transaction is rolled back, and the assets are returned to the liquidity pool.

### Benefits of Flash Loans on Binance Smart Chain

The introduction of flash loans on the Binance Smart Chain has brought several benefits to the DeFi ecosystem:

1. **Instant Liquidity**: Flash loans provide users with immediate access to capital, allowing them to execute high-value transactions without the need for collateral or lengthy approval processes.

2. **Reduced Transaction Costs**: Since flash loans eliminate the need for intermediaries, they can significantly reduce transaction costs, making DeFi more accessible to a wider audience.

3. **Enhanced Financial Products**: Flash loans enable the creation of new financial products and services that were previously impossible or too costly to implement. This includes decentralized exchanges, lending platforms, and insurance products.

4. **Increased Efficiency**: The ability to borrow and repay assets in a single transaction enhances the efficiency of DeFi applications, leading to faster and more seamless user experiences.

### Use Cases of Flash Loans on Binance Smart Chain

Flash loans on the Binance Smart Chain have a wide range of use cases, including:

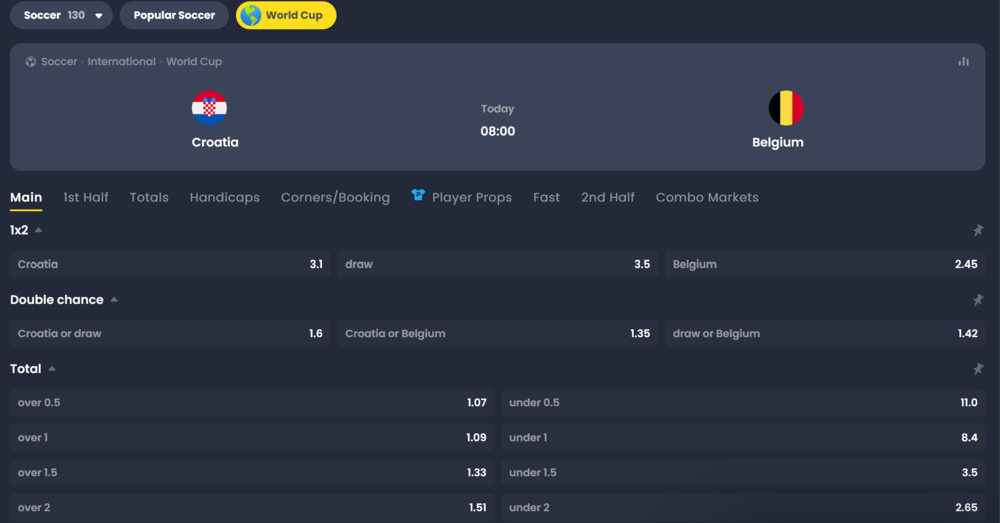

1. **Arbitrage Opportunities**: Traders can use flash loans to capitalize on price discrepancies between different exchanges, maximizing their profits.

2. **Leveraged Trading**: Users can borrow assets to increase their position size, potentially multiplying their gains. However, this also comes with higher risks.

3. **DeFi Protocols**: Many DeFi protocols leverage flash loans to provide liquidity and enhance their functionality. For example, decentralized exchanges use flash loans to facilitate instant swaps.

4. **Smart Contract Development**: Developers can use flash loans to test and deploy new smart contracts, ensuring they function as intended before full-scale deployment.

### The Impact of Flash Loans on the DeFi Ecosystem

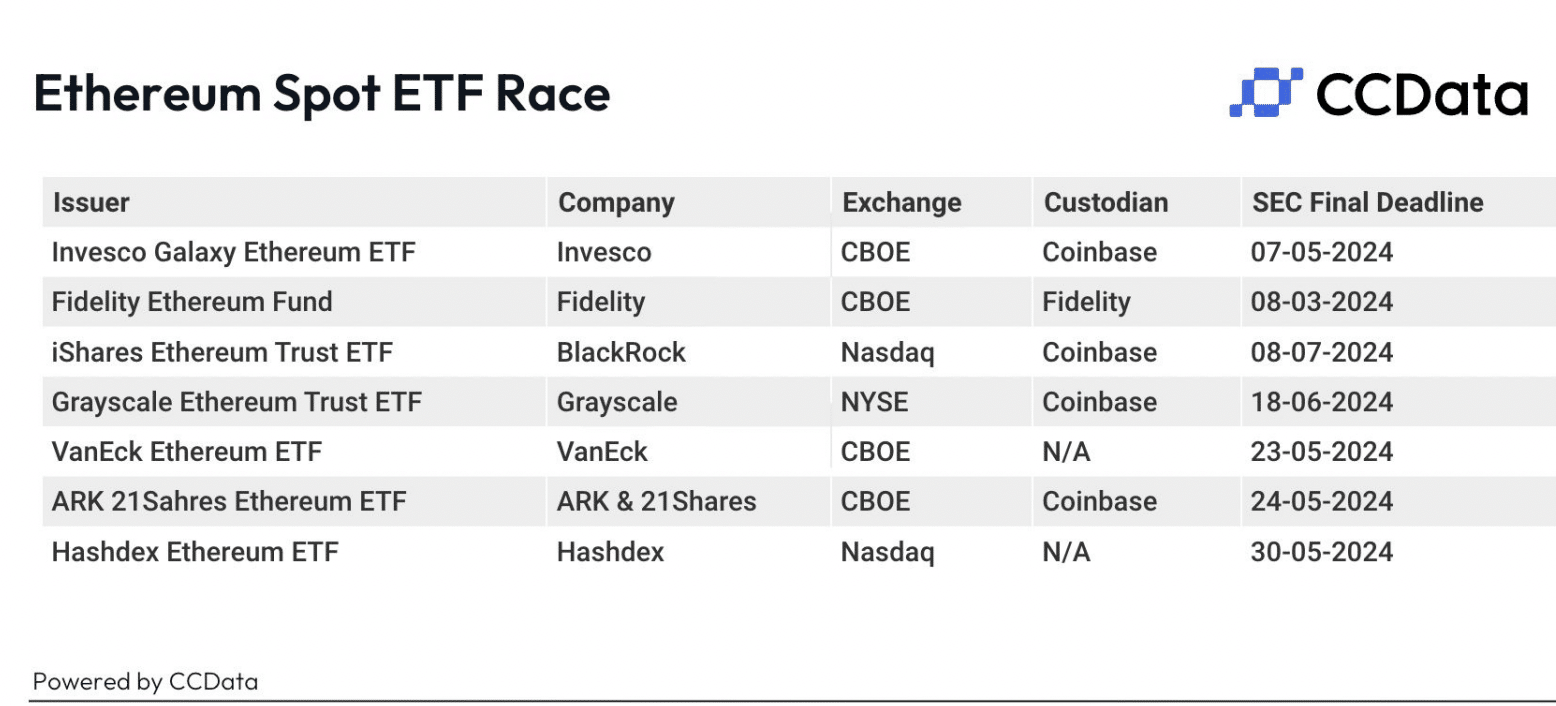

The introduction of flash loans on the Binance Smart Chain has had a profound impact on the DeFi ecosystem. By providing users with instant liquidity and reducing transaction costs, flash loans have made DeFi more accessible and efficient. This has led to a surge in the number of DeFi projects and a significant increase in the overall value locked in the ecosystem.

Moreover, flash loans have sparked innovation, with developers creating new financial products and services that were previously unimaginable. This has not only expanded the scope of DeFi but has also attracted new users and investors to the space.

### Conclusion

Flash loans on the Binance Smart Chain represent a significant advancement in the DeFi ecosystem. By providing instant liquidity and reducing transaction costs, flash loans have made DeFi more accessible and efficient. As the DeFi space continues to evolve, it is likely that flash loans will play an increasingly important role in shaping the future of finance.

This article address:https://www.nutcupcoffee.com/blog/44b75099205.html

Like!(3771)

Related Posts

- What is Bitcoin Wallet Blockchain?

- Rabbit Coin Binance: The Future of Cryptocurrency Trading

- How to Access Bitcoin Wallet.dat: A Comprehensive Guide

- Bitcoin Cash Masternodes: The Future of Decentralized Finance

- Bitcoin Iran Mining: A Resilient Industry in the Face of Sanctions

- Up Coin Binance: A Comprehensive Guide to Trading and Investing

- How High Will Bitcoin Cash Go?

- Best Bitcoin Wallet in Denmark: A Comprehensive Guide

- Bitcoin Mining Farm Island: A New Era in Cryptocurrency

- Can I Buy 500 Dollars Worth of Bitcoin?

Popular

- Title: Enhancing Your Crypto Trading Strategy with the Binance Average Price Calculator

- Bitcoin Halving Price Reddit: A Comprehensive Guide to Understanding the Impact

- Bitcoin Pool Mining Free Legit Online: A Comprehensive Guide

- Electrum Bitcoin Wallet App: The Ultimate Tool for Secure and Convenient Bitcoin Management

Recent

How Do You Get Listed on Binance?

i think someone is mining bitcoins on ourcompany servers

Run Bitcoin Mining Instead of Ads: A New Era of Profitable Content Creation

**Unable to Validate Bitcoin Cash Transaction Ledger: A Closer Look at the Issue

Bitcoin Opening Price Ripple: A Comprehensive Analysis

Up Coin Binance: A Comprehensive Guide to Trading and Investing

How Do I Get Bitcoin Cash from Private Key?

Binance Bitcoin Kopen: A Comprehensive Guide to Buying Bitcoin on Binance

links

- Jasmy Coin Binance Listing: A Milestone for the Blockchain Industry

- Buy Bitcoin Wallet South Africa: A Comprehensive Guide

- How to Cash Bitcoin in Pakistan: A Comprehensive Guide

- Bitcoin Lowest Price in 2021: A Deep Dive into the Crypto Winter

- How to Transfer AVAX from Binance to Your AVAX Wallet: A Step-by-Step Guide

- Trade on Margin Binance: A Comprehensive Guide to Leveraged Trading

- CumRocket Price Binance: A Comprehensive Analysis

- **The Rise of Chinese Bitcoin Mining Stock: A Game-Changer in Cryptocurrency

- How to Margin Trade on Binance: A Comprehensive Guide

- Title: Simplifying Bitcoin Transactions with Bitcoin Wallet Address for Windows 32bit