You are here:Bean Cup Coffee > chart

What Makes the Price of Bitcoin Go Up or Down?

Bean Cup Coffee2024-09-20 23:28:56【chart】0people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized digital currency, has been capturing the attention of inves airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized digital currency, has been capturing the attention of inves

Bitcoin, the world's first decentralized digital currency, has been capturing the attention of investors and enthusiasts alike since its inception in 2009. As one of the most volatile assets in the financial market, the price of Bitcoin has seen significant fluctuations over the years. Understanding what factors contribute to the price volatility is crucial for anyone looking to invest in or trade Bitcoin. This article aims to explore the various elements that can make the price of Bitcoin go up or down.

1. Market Supply and Demand

One of the primary factors that influence the price of Bitcoin is the basic economic principle of supply and demand. When the demand for Bitcoin increases, its price tends to rise, and vice versa. Several factors can affect the demand for Bitcoin, including:

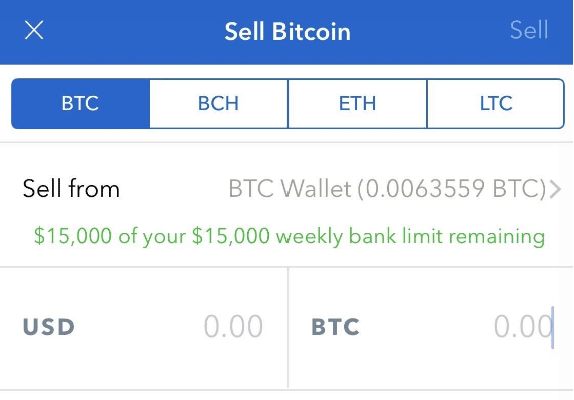

a. Adoption: As more individuals and businesses accept Bitcoin as a payment method, the demand for the cryptocurrency increases, potentially driving up its price.

b. Investment: Bitcoin has gained popularity as an investment asset, with many investors considering it as a hedge against inflation and traditional financial markets.

c. Media attention: Positive media coverage can boost the demand for Bitcoin, while negative news can lead to a decrease in demand and a subsequent drop in price.

2. Regulatory Environment

The regulatory landscape plays a crucial role in determining the price of Bitcoin. Governments and regulatory bodies around the world have varying stances on cryptocurrencies, which can impact the market in several ways:

a. Legalization: Countries that have legalized Bitcoin and other cryptocurrencies tend to see higher adoption rates, which can drive up the price.

b. Regulation: Excessive regulations can limit the use of Bitcoin and other cryptocurrencies, potentially leading to a decrease in demand and a drop in price.

c. Ban: A complete ban on cryptocurrencies can have a severe impact on the market, causing a significant drop in price.

3. Technological Developments

Technological advancements in the Bitcoin network can influence its price:

a. Blockchain scalability: Improvements in the scalability of the blockchain can increase the efficiency of transactions, potentially attracting more users and investors, thereby driving up the price.

b. Security: Any security breaches or vulnerabilities in the Bitcoin network can lead to a loss of trust, causing a decrease in demand and a drop in price.

4. Market Manipulation

Market manipulation can also play a role in the price volatility of Bitcoin. Large investors, known as whales, can influence the market by buying or selling large amounts of Bitcoin, which can cause significant price fluctuations.

5. Economic Factors

Economic factors, such as inflation, currency devaluation, and geopolitical events, can also impact the price of Bitcoin:

a. Inflation: Bitcoin is often seen as a hedge against inflation, as its supply is capped at 21 million coins. In times of high inflation, Bitcoin's price may increase as investors seek refuge in the cryptocurrency.

b. Currency devaluation: In countries with high inflation or economic instability, the value of the local currency may decrease, leading investors to look for alternative assets, such as Bitcoin.

c. Geopolitical events: Political instability or conflicts in major economies can lead to a decrease in the value of traditional assets, prompting investors to seek alternative investments like Bitcoin.

In conclusion, the price of Bitcoin can go up or down due to a variety of factors, including market supply and demand, regulatory environment, technological developments, market manipulation, and economic factors. Understanding these elements can help investors make informed decisions and navigate the volatile world of Bitcoin trading.

This article address:https://www.nutcupcoffee.com/blog/73a54799379.html

Like!(654)

Related Posts

- Is Bitcoin Mining Illegal in Nepal?

- How to Transfer Bitcoins to Different Wallet: A Comprehensive Guide

- The video card bitcoin price has been a hot topic among cryptocurrency enthusiasts and tech-savvy individuals alike. With the increasing popularity of Bitcoin and other cryptocurrencies, the demand for video cards has surged, leading to a significant rise in their prices. In this article, we will delve into the factors contributing to the video card bitcoin price and explore the potential implications for the market.

- How to Pay Taxes on Bitcoin Mining: A Comprehensive Guide

- Bitcoin Free Mining: A Lucrative Opportunity in the Cryptocurrency World

- The Rise of ELFBTC Binance: A Game-Changer in the Cryptocurrency World

- What Are Shares Bitcoin Mining: Understanding the Concept

- Futuros de Bitcoin Binance: A Comprehensive Guide to Trading Bitcoin Futures on Binance

- Binance, one of the leading cryptocurrency exchanges in the world, has recently announced the listing of TAO, a token that has been generating quite a buzz in the crypto community. The addition of TAO to Binance's platform is a significant development for both the token and its investors, as it opens up a new avenue for trading and liquidity.

- **Legit Bitcoin Mining Free: Is It Possible and How to Do It?

Popular

Recent

Binance Bake Coin: A New Era of Crypto Innovation

Use Real Email for Bitcoin Wallet: Why It Matters

Software Mining Bitcoin Terbaik: Enhancing Your Cryptocurrency Mining Experience

Online Bitcoin Mining Games: A Fun and Rewarding Experience

Bitcoin Price Before and After Halving: A Comprehensive Analysis

Can I Buy Bitcoin with Debit Card on Coinbase?

How to See My Bitcoin Wallet Address on Blockchain: A Comprehensive Guide

Futuros de Bitcoin Binance: A Comprehensive Guide to Trading Bitcoin Futures on Binance

links

- Swapping Bitcoin for BNB Trust Wallet: A Comprehensive Guide

- Bitcoin Mining Tickers: The Essential Tool for Monitoring Your Investment

- Bitcoin Price USD Hits All-Time High: What Does It Mean for the Future?

- Binance and Trust Wallet Giveaway: A Great Opportunity for Crypto Enthusiasts

- Bitcoin Mining with Xbox 360: A Surprising Solution for Crypto Enthusiasts

- Title: Convert Price Bitcoin to Bitcoin Cash: Understanding the Transition

- Binance Lite App: A User-Friendly Gateway to Cryptocurrency Trading

- Bitcoin Mining Simulator Roblox Wiki: A Comprehensive Guide to the Virtual Mining World

- Bitcoin Price Invest: Navigating the Volatile Landscape of Cryptocurrency Investments

- Bitcoin Cash Kurs Sek: A Comprehensive Analysis