You are here:Bean Cup Coffee > bitcoin

Bitcoin and Ethereum Price Prediction: A Comprehensive Analysis

Bean Cup Coffee2024-09-20 21:42:12【bitcoin】4people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, cryptocurrencies have gained significant attention from investors and enthusiasts w airdrop,dex,cex,markets,trade value chart,buy,In recent years, cryptocurrencies have gained significant attention from investors and enthusiasts w

In recent years, cryptocurrencies have gained significant attention from investors and enthusiasts worldwide. Among the numerous digital currencies available, Bitcoin and Ethereum have emerged as the two most prominent ones. With their increasing popularity, many individuals and organizations are eager to predict their future prices. This article aims to provide a comprehensive analysis of Bitcoin and Ethereum price prediction, considering various factors that may influence their market performance.

Bitcoin and Ethereum Price Prediction: Factors to Consider

1. Market Supply and Demand

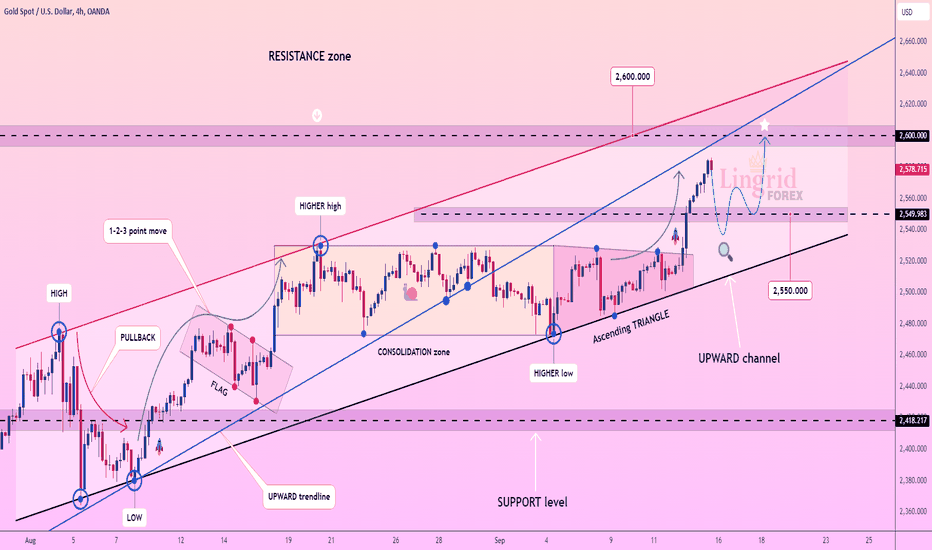

One of the primary factors affecting the price of Bitcoin and Ethereum is the supply and demand dynamics in the market. When demand for these cryptocurrencies increases, their prices tend to rise, and vice versa. Factors such as regulatory news, technological advancements, and adoption rates can significantly impact the supply and demand for these digital assets.

2. Technological Developments

The technological advancements in the blockchain industry can have a substantial impact on the prices of Bitcoin and Ethereum. For instance, the successful implementation of the Ethereum 2.0 upgrade is expected to enhance the network's scalability and efficiency, potentially leading to increased adoption and higher prices.

3. Regulatory Environment

The regulatory landscape plays a crucial role in shaping the market dynamics of Bitcoin and Ethereum. Governments worldwide are still in the process of formulating policies regarding cryptocurrencies. Positive regulatory news can boost investor confidence and drive up prices, while negative news can lead to a decline in value.

4. Market Sentiment

Market sentiment is another critical factor influencing the prices of Bitcoin and Ethereum. Investors' perceptions and emotions can cause significant price volatility. For instance, during the 2017 bull run, Bitcoin and Ethereum experienced exponential growth due to widespread optimism in the market.

Bitcoin and Ethereum Price Prediction: Short-term vs. Long-term

Short-term price predictions for Bitcoin and Ethereum are often challenging due to the high volatility in the market. However, some experts believe that Bitcoin's price may reach $100,000 by the end of 2021, driven by increasing institutional adoption and a growing number of retail investors. Ethereum's price is also expected to rise, potentially surpassing $5,000 by the end of the year.

Long-term price predictions for Bitcoin and Ethereum are more optimistic. Many experts believe that these cryptocurrencies have the potential to become mainstream assets, with Bitcoin potentially reaching $1 million by 2030 and Ethereum surpassing $50,000. Factors such as increasing adoption, technological advancements, and a favorable regulatory environment are expected to contribute to these long-term price predictions.

Bitcoin and Ethereum Price Prediction: Risks and Considerations

While Bitcoin and Ethereum have the potential for significant growth, it is essential to consider the risks involved. Cryptocurrency markets are highly volatile, and prices can plummet as quickly as they rise. Additionally, regulatory risks, security concerns, and technological challenges can impact the market performance of these digital assets.

Conclusion

Predicting the future prices of Bitcoin and Ethereum is a complex task, as it involves analyzing various factors that can influence their market performance. While short-term predictions may be challenging, long-term price predictions are more optimistic, with potential for substantial growth. However, investors should exercise caution and conduct thorough research before making investment decisions in the cryptocurrency market.

This article address:https://www.nutcupcoffee.com/blog/78b63299289.html

Like!(6)

Related Posts

- The Importance of the Most Accurate Bitcoin Mining Calculator

- August 2019 Bitcoin Price: A Look Back at the Market's Volatility

- The Rise of XVG Coin on Binance: A Game-Changing Cryptocurrency

- The Rise of XVG Coin on Binance: A Game-Changing Cryptocurrency

- Title: Understanding the Importance of Your Indirizzo Bitcoin Wallet

- Reecover Bitcoin Wallet: A Secure and User-Friendly Solution for Cryptocurrency Management

- Binance Smart Chain Scams: Unraveling the Risks and Protecting Your Investments

- Title: Enhancing Cryptocurrency Management with the Wan Binance Wallet

- Bitstamp Bitcoin Wallet: A Secure and User-Friendly Solution for Cryptocurrency Storage

- New York Bitcoin Mining: A Booming Industry in the Heart of the Big Apple

Popular

Recent

Can I Buy Bitcoin on IG: A Comprehensive Guide

Bitcoin Core Where is Wallet.dat: A Comprehensive Guide

Bitcoin Price Monitoring App: Your Ultimate Tool for Cryptocurrency Investors

Bitcoin Wallet in Jamaica: A Gateway to Financial Freedom

Coinbase Bitcoin Wallet Android: The Ultimate Guide to Managing Your Cryptocurrency

Who Is Pro Bitcoin Cash?

What Happened to Bitcoin Cash?

What is Bitcoin Cash YouTube: A Comprehensive Guide

links

- Bitcoin Cash Cold Wallet: A Secure Solution for Storing Your Cryptocurrency

- Binance Not Allowing Us Citizens to Continue Trading: What Does It Mean for the Cryptocurrency Market?

- Bitcoin Wallet iOS Empfehlung: Top 5 Apps for Safe and Secure Cryptocurrency Management

- Binance New Coin Alert: Exciting Developments in the Cryptocurrency Market

- Binance Singapore Withdrawal Fee: Understanding the Costs and Strategies to Minimize Them

- Bitcoin Mining NY: The Thriving Scene in New York City

- Opening an Old Bitcoin Wallet Hangs: What to Do?

- Lowest Price of Bitcoin in 2023: A Comprehensive Analysis

- Can We Sell Bitcoin in India?