You are here:Bean Cup Coffee > news

Can U.S. Corporations Trade Stock in Bitcoin?

Bean Cup Coffee2024-09-20 23:40:56【news】1people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the rise of cryptocurrencies has been a topic of intense debate and speculation. Wi airdrop,dex,cex,markets,trade value chart,buy,In recent years, the rise of cryptocurrencies has been a topic of intense debate and speculation. Wi

In recent years, the rise of cryptocurrencies has been a topic of intense debate and speculation. With Bitcoin being the most prominent cryptocurrency, many are curious about whether U.S. corporations can trade stock in Bitcoin. This article aims to explore the feasibility and implications of U.S. corporations trading stock in Bitcoin.

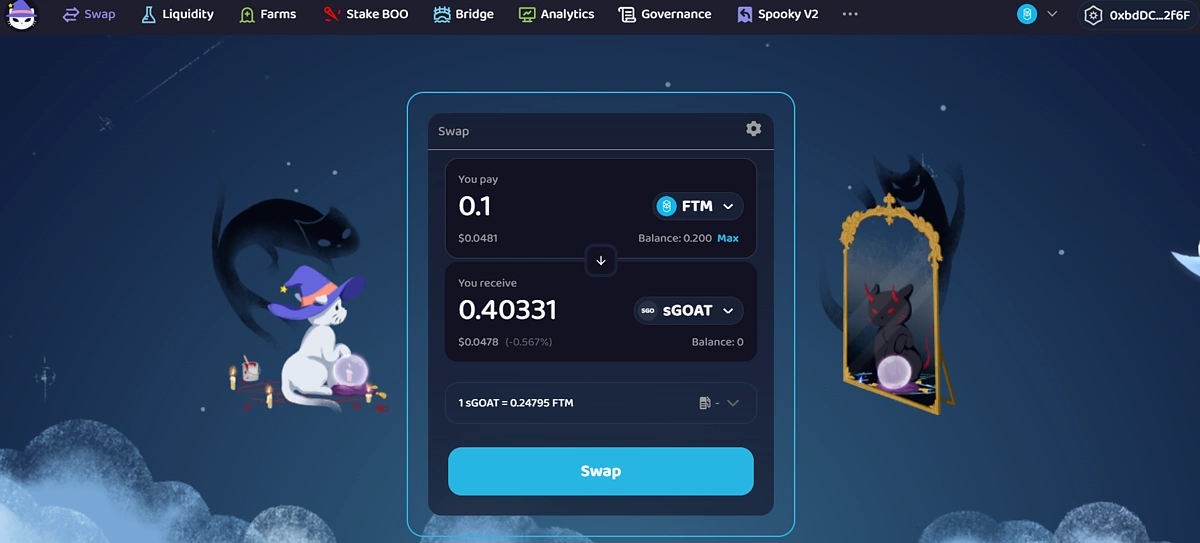

Firstly, it is essential to understand that trading stock in Bitcoin is not the same as holding Bitcoin as an investment. When a corporation trades stock in Bitcoin, it means that the stock is exchanged for Bitcoin, rather than being traded on a traditional stock exchange. This distinction is crucial in determining the legality and practicality of such a transaction.

The legality of U.S. corporations trading stock in Bitcoin is a complex issue. Currently, the U.S. Securities and Exchange Commission (SEC) has not explicitly approved the trading of stock in Bitcoin. However, there are no specific regulations that explicitly prohibit it either. This creates a gray area where corporations may be able to trade stock in Bitcoin, but they must navigate the legal landscape carefully.

One of the primary concerns regarding the legality of trading stock in Bitcoin is the classification of cryptocurrencies as securities. The Howey Test, a legal framework used to determine whether an asset is a security, could be applied to cryptocurrencies. If Bitcoin is deemed a security, then trading stock in Bitcoin would be subject to the same regulations as traditional securities.

Another challenge is the volatility of Bitcoin. Its price can fluctuate significantly within a short period, which poses risks for corporations. If a corporation trades stock in Bitcoin, it would be exposed to the volatility of the cryptocurrency market, potentially leading to significant financial losses. This risk could deter corporations from engaging in such transactions.

Moreover, the regulatory environment surrounding cryptocurrencies is still evolving. As the SEC and other regulatory bodies continue to develop rules and guidelines, it is uncertain how they will view the trading of stock in Bitcoin. This uncertainty adds to the risks associated with such transactions.

Despite the legal and regulatory challenges, there are potential benefits to U.S. corporations trading stock in Bitcoin. One significant advantage is the potential for cost savings. Cryptocurrencies offer a decentralized and borderless transaction system, which can reduce transaction costs and increase efficiency. By trading stock in Bitcoin, corporations may benefit from lower fees and faster settlement times compared to traditional financial systems.

Furthermore, trading stock in Bitcoin could provide corporations with a new avenue for diversification. As Bitcoin has shown significant growth in recent years, it could serve as a hedge against traditional financial markets. By incorporating Bitcoin into their investment portfolios, corporations may be able to mitigate risks and potentially achieve higher returns.

In conclusion, while the legality and practicality of U.S. corporations trading stock in Bitcoin remain uncertain, there are potential benefits and challenges to consider. As the regulatory landscape continues to evolve, it is crucial for corporations to stay informed and navigate the legal complexities carefully. While trading stock in Bitcoin may not be a feasible option for all corporations, it is an intriguing possibility that could offer unique advantages in the future.

This article address:https://www.nutcupcoffee.com/blog/98f75499147.html

Like!(498)

Related Posts

- When Raca List Binance: A Comprehensive Guide to Understanding the Cryptocurrency Platform

- Title: A Step-by-Step Guide to Buying Decred on Binance

- Title: The Current Conversion Rate of 1 Binance Coin to Turkish Lira (1 Binance Coin Kaç TL)

- FEG Listing on Binance: A Game-Changing Move for the Cryptocurrency Community

- Binance Withdrawal Reddit: A Comprehensive Guide to Binance Withdrawal Process

- Does Bitcoin Cash Have a Limit?

- Bitcoin Price List in India: A Comprehensive Guide to Cryptocurrency Values

- Title: Optimizing Your Bitcoin Mining Experience with the Right OS for Mining Bitcoin

- How Bitcoin Mining Works: A Comprehensive Guide

- Title: Exploring the World Bitcoin Mining Telegram: A Hub for Crypto Enthusiasts

Popular

Recent

Bitcoin Mining Smartphone: The Future of Cryptocurrency on the Go

Bitcoin Gold BTG Price Prediction: What the Future Holds for This Cryptocurrency

Title: Enhancing Your Cryptocurrency Experience with the Bitcoin Wallet Mac Desktop Application

Can I Sell Bitcoins on OTCBTC?

Bitcoin Cash Casino Florida: A New Era of Online Gaming

Bitcoin Mining Pro APK: The Ultimate Guide to Cryptocurrency Mining on Your Android Device

Can You Earn Crypto on Binance?

Hash Mining Bitcoin: The Power Behind the Cryptocurrency

links

- Bitcoin Price Analyst: Decoding the Cryptocurrency Market

- Is Mining Bitcoin Risky?

- Bitcoin Price Exchange Rate: Fluctuations and Implications

- Galaxy S5 Bitcoin Mining Rig: A Cost-Effective Solution for Crypto Enthusiasts

- **Withdraw Shiba Inu from Binance: A Step-by-Step Guide

- Where Does Bitcoin Core Store Wallet?

- Binance Withdrawal Address: Ensuring Secure and Efficient Transactions

- Bitcoin Mining: How Many Coins Can You Mine?

- What is Bitcoin Mining and Is It Profitable?

- Binance Withdrawal Address: Ensuring Secure and Efficient Transactions