You are here:Bean Cup Coffee > block

Will Bitcoin Price Go Up After Fork?

Bean Cup Coffee2024-09-20 23:46:00【block】0people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market has been abuzz with discussions about the upcoming Bitcoin fork, and many airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market has been abuzz with discussions about the upcoming Bitcoin fork, and many

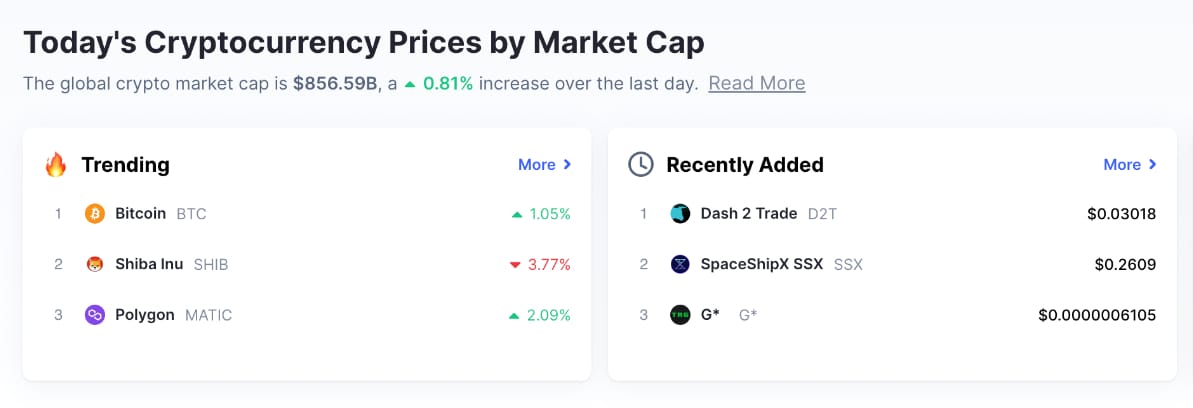

The cryptocurrency market has been abuzz with discussions about the upcoming Bitcoin fork, and many investors are wondering whether the price of Bitcoin will go up after the fork. A fork, in the context of cryptocurrencies, refers to a split in the blockchain, resulting in two separate chains. This article aims to explore the potential impact of the Bitcoin fork on its price.

Firstly, it is important to understand the reasons behind the Bitcoin fork. The Bitcoin network has been facing scalability issues, primarily due to its limited block size. This has led to increased transaction fees and slower confirmation times. To address these issues, a group of Bitcoin developers proposed a fork, which would increase the block size limit and implement other improvements to the network.

The potential impact of the Bitcoin fork on its price can be analyzed from two perspectives: short-term and long-term.

In the short term, the Bitcoin price may experience volatility following the fork. This is because the fork is a significant event that could lead to uncertainty among investors. Some may believe that the new chain will become the dominant version of Bitcoin, while others may prefer the original chain. This uncertainty can cause a temporary drop in the price of Bitcoin as investors react to the news.

However, in the long term, the Bitcoin price may go up after the fork. There are several reasons for this:

1. Improved scalability: The main purpose of the fork is to address the scalability issues of the Bitcoin network. By increasing the block size limit, the network can handle more transactions, which can lead to lower transaction fees and faster confirmation times. This can attract more users to the network, which may result in an increase in demand for Bitcoin and, consequently, its price.

2. Enhanced network security: The fork may also introduce improvements to the network's security. For instance, the new chain could implement better consensus algorithms or address vulnerabilities in the original chain. A more secure network can instill confidence in investors, leading to increased demand for Bitcoin and a potential price increase.

3. Market sentiment: The Bitcoin community has been divided over the fork, with some supporting it and others opposing it. However, the fact that a fork is happening indicates that there is a strong desire among Bitcoin users to improve the network. This can generate positive market sentiment, which may drive the price of Bitcoin higher.

4. Competition: The fork may create a new cryptocurrency that competes with Bitcoin. While this could initially lead to a drop in Bitcoin's market share, it may also encourage innovation and development within the Bitcoin ecosystem. As a result, the overall value of the Bitcoin network could increase, potentially leading to a higher price.

In conclusion, while the Bitcoin price may experience volatility in the short term following the fork, it is possible that the price will go up in the long term. The improved scalability, enhanced network security, market sentiment, and competition are all factors that could contribute to a potential price increase. However, it is important to note that the cryptocurrency market is highly unpredictable, and there are no guarantees regarding the future price of Bitcoin. Investors should carefully consider the risks and rewards before making any investment decisions.

This article address:https://www.nutcupcoffee.com/blog/99f53099370.html

Like!(9)

Related Posts

- When Raca List Binance: A Comprehensive Guide to Understanding the Cryptocurrency Platform

- Fast Bitcoin Miner How to Download and Start Mining

- How to Send Bitcoin from Blockchain to Cash App

- Connect Meta Mask to Binance Smart Chain: A Step-by-Step Guide

- Unlocking the Potential of Binance with a 200 USDT Coupon

- Blockchain Bitcoin Cash: Revolutionizing the Financial World

- Binance List: The Ultimate Guide to Binance's Cryptocurrency Exchange

- When Bitcoin Started: What Was the Price?

- Binance Trade History Export: A Comprehensive Guide to Managing Your Trading Data

- Which Wallet to Use for Bitcoin: A Comprehensive Guide

Popular

Recent

015 Bitcoin to Cash: The Intersection of Digital Currency and Traditional Transactions

Is the Price of Bitcoin and Other Cryptocurrencies Falling?

Profitable Bitcoin Mining for Everyone: A Comprehensive Guide

How to Transfer from Coinbase to Binance.US: A Step-by-Step Guide

The S Fox Bitcoin Wallet: A Comprehensive Guide to Secure Cryptocurrency Management

The Rise of BTC/USDC on Binance: A Game-Changing Cryptocurrency Pair

### Navigating the World of Cryptocurrency Exchange: USDT to Naira on Binance

Is My Bitcoin Cash Gone If I Have Coinbase?

links

- How to Withdraw Money from Bitcoin Wallet in Pakistan

- Which Bitcoin Wallet is the Safest: A Comprehensive Guide

- Bitcoin Mining Farm Locations: The Global Spread of Cryptocurrency Powerhouses

- Bitcoin Price History from 2010: A Decade of Volatility and Growth

- Unlock Bitcoin Core Wallet: A Comprehensive Guide to Managing Your Cryptocurrency

- Bitcoin Original Price: A Journey Through Time

- Where to Buy Safemoon Coin on Binance: A Comprehensive Guide

- How to Transfer USD from Coinbase to Binance: A Step-by-Step Guide

- Best Bitcoin Debit Cards Can Curtency: A Comprehensive Guide

- Alfred Talahuron Philippines Bitcoin Crypto Mining: A Revolution in Digital Currency