You are here:Bean Cup Coffee > news

Bitcoin Cash Investment Fund: A Lucrative Opportunity in the Cryptocurrency Market

Bean Cup Coffee2024-09-21 04:38:46【news】0people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has experienced exponential growth, with Bitcoin leading airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has experienced exponential growth, with Bitcoin leading

In recent years, the cryptocurrency market has experienced exponential growth, with Bitcoin leading the pack. However, Bitcoin Cash, a hard fork of Bitcoin, has gained significant attention and is now considered a viable investment option. One of the most popular ways to invest in Bitcoin Cash is through a Bitcoin Cash Investment Fund. This article will discuss the benefits of investing in a Bitcoin Cash Investment Fund and why it is a lucrative opportunity in the cryptocurrency market.

What is a Bitcoin Cash Investment Fund?

A Bitcoin Cash Investment Fund is a pooled investment vehicle that allows investors to invest in Bitcoin Cash without having to buy and store the cryptocurrency themselves. The fund is managed by professionals who have extensive knowledge of the cryptocurrency market and are responsible for buying, selling, and managing the Bitcoin Cash portfolio.

Benefits of Investing in a Bitcoin Cash Investment Fund

1. Diversification: By investing in a Bitcoin Cash Investment Fund, investors can diversify their cryptocurrency portfolio. This is important because it reduces the risk of investing in a single cryptocurrency, as the value of Bitcoin Cash can be affected by various factors, including market volatility and regulatory changes.

2. Expert Management: The professionals managing a Bitcoin Cash Investment Fund have extensive knowledge of the cryptocurrency market and are well-equipped to make informed decisions regarding the investment strategy. This ensures that the fund's portfolio is well-diversified and managed effectively.

3. Accessibility: Investing in a Bitcoin Cash Investment Fund is accessible to both experienced and novice investors. The fund's professionals handle all the complexities of buying, selling, and managing Bitcoin Cash, making it easier for investors to participate in the cryptocurrency market.

4. Tax Advantages: Investing in a Bitcoin Cash Investment Fund may offer tax advantages, as the fund's professionals can help investors navigate the complex tax regulations surrounding cryptocurrency investments.

5. Potential for High Returns: Bitcoin Cash has shown significant growth since its inception, and its potential for high returns makes it an attractive investment option. By investing in a Bitcoin Cash Investment Fund, investors can benefit from the fund's expertise and potentially earn substantial returns.

Risks of Investing in a Bitcoin Cash Investment Fund

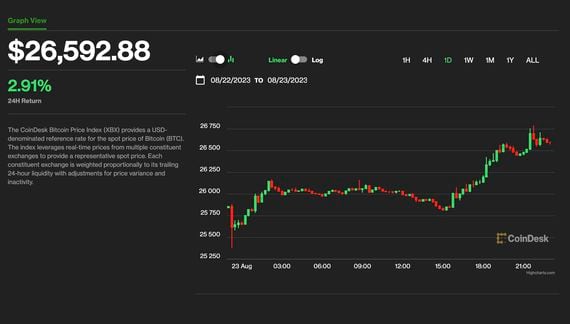

1. Market Volatility: The cryptocurrency market is known for its volatility, and Bitcoin Cash is no exception. This means that the value of the fund's investments can fluctuate significantly, which can be a risk for investors.

2. Regulatory Risks: The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations can impact the value of Bitcoin Cash and, consequently, the performance of the investment fund.

3. Security Risks: As with any investment, there are security risks associated with investing in a Bitcoin Cash Investment Fund. Investors should ensure that the fund's management team has robust security measures in place to protect their investments.

Conclusion

Investing in a Bitcoin Cash Investment Fund is a lucrative opportunity for those looking to diversify their cryptocurrency portfolio and benefit from the potential growth of Bitcoin Cash. With expert management, accessibility, and tax advantages, a Bitcoin Cash Investment Fund can be an attractive option for both experienced and novice investors. However, it is essential to understand the risks involved and conduct thorough research before investing.

This article address:https://www.nutcupcoffee.com/crypto/63a09999837.html

Like!(6841)

Related Posts

- How Much I Can Earn from Bitcoin Mining: A Comprehensive Guide

- Can You Make Your Own Bitcoin Wallet?

- Bitcoin Price Now Real Time: The Ever-Changing Landscape of Cryptocurrency

- Binance Smart Chain Ledger Nano: The Ultimate Combination for Secure Crypto Storage

- Crypto.com versus Binance: A Comprehensive Comparison

- Trading P2P Binance: A Comprehensive Guide to Peer-to-Peer Cryptocurrency Trading on Binance

- Bitcoin Mining Beginner Reddit: A Comprehensive Guide for Newcomers

- So Much Right Now Bitcoin Price: The Current State of the Cryptocurrency Market

- What is Bitcoin Cash App?

- How to Sell Bitcoin for Cash on Binance: A Step-by-Step Guide

Popular

Recent

How to Withdraw to Bank Account from Binance: A Step-by-Step Guide

How to Sell Bitcoin for Cash on Binance: A Step-by-Step Guide

What's the Price of 3 Bitcoin: A Comprehensive Guide

Le binance coin peut-il monter : A Comprehensive Analysis

Buying Bitcoins with Cash in the UK: A Comprehensive Guide

Binance Price Prediction: The Future of Cryptocurrency Trading

Bitcoin Price Prediction Bottom: A Comprehensive Analysis

Anthony Pompliano Bitcoin Price Prediction: A Glimpse into the Future

links

- How to Build a Web Wallet with Bitcoin Core: A Comprehensive Guide

- Do You Have to Give Details for Bitcoin Wallets?

- Buy Domain with Bitcoin Cash: A New Era of Digital Ownership

- Title: Exploring the World of BTCMinerGenerator.com Bitcoin Online Mining

- Bitcoin Cash USD Value: A Comprehensive Analysis

- USDT to Naira in Binance Today: A Comprehensive Guide

- The Importance of a Ticker That Shows the Price of Bitcoin

- Bitcoin Mining Hardware Guide: Everything You Need to Know

- Bitcoin Cash Live Feed: Keeping Track of the World's Largest Cryptocurrency

- Bitcoin Highest Price History: A Journey Through the Volatile Cryptocurrency Market