You are here:Bean Cup Coffee > chart

How Will Halving Affect Bitcoin Price?

Bean Cup Coffee2024-09-20 23:49:58【chart】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The Bitcoin halving event, which occurs approximately every four years, has always been a topic of g airdrop,dex,cex,markets,trade value chart,buy,The Bitcoin halving event, which occurs approximately every four years, has always been a topic of g

The Bitcoin halving event, which occurs approximately every four years, has always been a topic of great interest and speculation in the cryptocurrency community. The next halving is expected to take place in 2024, and many are wondering how it will affect the price of Bitcoin. In this article, we will explore the potential impact of the halving on the Bitcoin price and discuss the various factors that could come into play.

Firstly, it is important to understand what the halving event entails. During the halving, the reward for mining a new block is halved. This means that miners will receive fewer Bitcoin for their efforts. The purpose of this event is to control the supply of Bitcoin and ensure that it reaches its predetermined limit of 21 million coins.

One of the primary reasons why the halving is expected to have a significant impact on the Bitcoin price is the supply and demand dynamics. When the reward for mining is halved, it becomes more difficult for miners to generate new Bitcoin. This could lead to a decrease in the overall supply of Bitcoin in the market. As a result, the price of Bitcoin may increase due to the reduced supply and the increased demand from investors and traders.

However, the impact of the halving on the Bitcoin price is not guaranteed to be positive. There are several factors that could influence the outcome. One of the key factors is the behavior of Bitcoin investors and traders. If they believe that the halving will lead to a significant increase in the price of Bitcoin, they may start buying more Bitcoin in anticipation of this increase. This could drive the price up even before the actual halving event takes place.

On the other hand, some investors may view the halving as a sign of potential volatility in the market. They may choose to sell their Bitcoin instead of holding onto it, which could lead to a decrease in the price. This uncertainty can make it difficult to predict how the halving will affect the Bitcoin price.

Another factor to consider is the overall sentiment in the cryptocurrency market. If the market is experiencing a bearish trend, the halving may not have a significant impact on the Bitcoin price. However, if the market is in a bullish phase, the halving could act as a catalyst for further price increases.

Furthermore, the regulatory environment can also play a role in how the halving affects the Bitcoin price. Governments and regulatory bodies around the world have varying stances on cryptocurrencies, and any changes in regulations could impact the demand for Bitcoin. For example, if a major country were to ban cryptocurrencies, it could lead to a significant decrease in the price of Bitcoin.

In conclusion, the halving event is a significant milestone in the Bitcoin ecosystem, and it is expected to have a profound impact on the Bitcoin price. While the supply and demand dynamics suggest that the price may increase, there are several factors that could influence the outcome. The behavior of investors, the overall market sentiment, and regulatory changes are all potential factors that could affect the price of Bitcoin following the halving. As such, it is crucial for investors to stay informed and cautious when considering the potential impact of the halving on the Bitcoin price. How will halving affect Bitcoin price? The answer may not be clear-cut, but it is a question that will continue to captivate the cryptocurrency community as we approach the next halving event.

This article address:https://www.nutcupcoffee.com/eth/49b58699364.html

Like!(43)

Related Posts

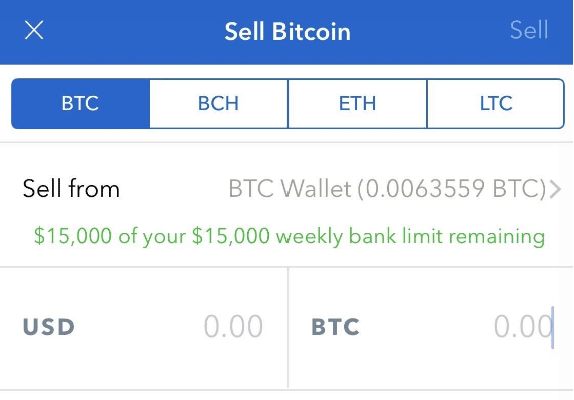

- Title: How to Buy Bitcoin Using the Cash App: A Step-by-Step Guide

- Step Coin Binance: A Comprehensive Guide to Understanding and Utilizing This Innovative Cryptocurrency Platform

- Bitcoin Wallet Cracker: A Deep Dive into the World of Cryptocurrency Security Breaches

- Bitcoin Mining Single Computer Daily Profit: A Comprehensive Guide

- Bitcoin Price Today GBP: A Comprehensive Analysis

- How to Send Bitcoin on Cash App in 2024

- Best Bitcoin Mining Pool: The Ultimate Guide to Choosing the Right Platform

- **Smart Outlet for Mining Bitcoin: A Game-Changer in Cryptocurrency Mining

- How to Stop Loss on the Binance App: A Comprehensive Guide

- The 1 Share Price of Bitcoin: A Comprehensive Analysis

Popular

Recent

Bitcoin Price in Future: A Comprehensive Analysis

How to Transfer ETH to Binance Smart Chain Metamask: A Step-by-Step Guide

Bitcoin Price Before and After Halving: A Comprehensive Analysis

How to Withdraw USDT from Binance: A Step-by-Step Guide

The Rise and Fall of Bitcoin's Highest Price: A Journey Through the Cryptocurrency Market

How to Transfer from Binance Back to Coinbase in 2019

**Mining Bitcoin with Raspberry Pi: A Cost-Effective Approach

Bitcoin Mining Single Computer Daily Profit: A Comprehensive Guide

links

- How Much Do You Get from Mining Bitcoin?

- Bitcoin Wallet App Apple: A Comprehensive Guide to Managing Your Cryptocurrency

- The Evolution of Digital Currencies: Tron to Bitcoin Cash

- Who is the Founder of Bitcoin Cash?

- Bitcoin Mining Software Ubuntu: A Comprehensive Guide

- Funding My Bitcoin Wallet: A Comprehensive Guide

- How to Transfer from Bitcoin Wallet to BitPay Visa

- Bitcoin Price Yesterday AUD: A Closer Look at the Cryptocurrency Market

- Bitcoin Mining Software Ubuntu: A Comprehensive Guide

- Binance Bitcoin Airdrop: A Comprehensive Guide to Claim Your Free Cryptocurrency